CPA vs. Accountant: Answering 5 Questions For Future Accounting Professionals

For professionals who want to enter the accounting field, it’s common to wonder what the difference is between an accountant and a CPA. While it may seem that people use these terms interchangeably, there are distinctions between these professionals.

This guide will help you differentiate between a CPA and an accountant, as well as answer pressing questions about how these designations impact an accountant’s career path.

Is a CPA the Same as an Accountant?

A CPA is not the same as an accountant. An accountant is typically a professional who has earned a bachelor’s degree in accounting. A CPA, or Certified Public Accountant, is a professional who has earned their CPA license through a combination of education, experience and examination.

CPAs are different from an unlicensed accountant because:

- CPAs are licensed by a professional governing body.

- CPAs have requirements for continuing education in order to maintain their license.

- CPAs are held to specific professional standards and a code of ethics.

- CPAs are held to a fiduciary standard, which means they must put their clients’ interests first above all else.

While all CPAs are accountants, not all accountants are CPAs. In fact, according to data from the Bureau of Labor Statistics (BLS), and CPA licensure data, only about 50% of accountants in the United States are actively licensed CPAs.

Both of these paths are viable long-term career options for aspiring accounting professionals. Let’s dive deeper into the differences so you can choose which path is right for you.

CPA vs. Accountant: Do They Have Different Responsibilities?

While CPAs and accountants perform similar tasks, there are multiple differences in the functions they perform.

An accountant is qualified to manage day-to-day financial activity. These responsibilities include:

- Organizing and recording financial transactions, including accounts payable, accounts receivable, depreciation and journal entries, and collections.

- Reconciling accounts at the end of the month or year to ensure all accounts and financial transactions are consistent.

- Analyzing financial statements to examine cash flow, calculate accounting ratios, and make expense recommendations to help a business operate more efficiently.

- Preparing budgets for departments and companies to help control operating costs.

Ready to make your move in accounting? Gain insights for every career stage in our free Accounting Career Guide.

While accountants are expected to perform all of these duties according to best practices and conduct themselves in an ethical way, there is no governing body that requires them to do so. This professional oversight is one of the key differences between accountants and CPAs.

CPAs are licensed professionals, which requires them to adhere to more stringent standards than unlicensed accountants. CPAs are expected to abide by the AICPA (Association of International Certified Professional Accountants) Professional Code of Conduct, which includes treating clients with objectivity, integrity and truthfulness while remaining free of conflicts of interest.

CPAs must also perform continuing education on a yearly basis in order to maintain their knowledge of best-practice accounting standards.

Because of these high standards, CPAs are recognized by the government as experts in the field. Therefore, CPAs are seen as better qualified to perform accounting functions and are allowed to execute duties that other accountants can’t, including:

- Preparing audited financial statements. This is required for reports filed with the Securities and Exchange Commission (SEC), which is a requirement for all publicly held companies.

- Acting as representation in front of the IRS. A CPA can represent taxpayers and companies in the event of an audit. While accountants can prepare tax returns, only a CPA can defend a return if the IRS or state tax authorities have questions or concerns.

- Conducting company audits. While in-house audits may be completed by an accountant, external audits or auditing of public companies is always handled by a CPA.

CPA vs. Accountant: Who Makes More?

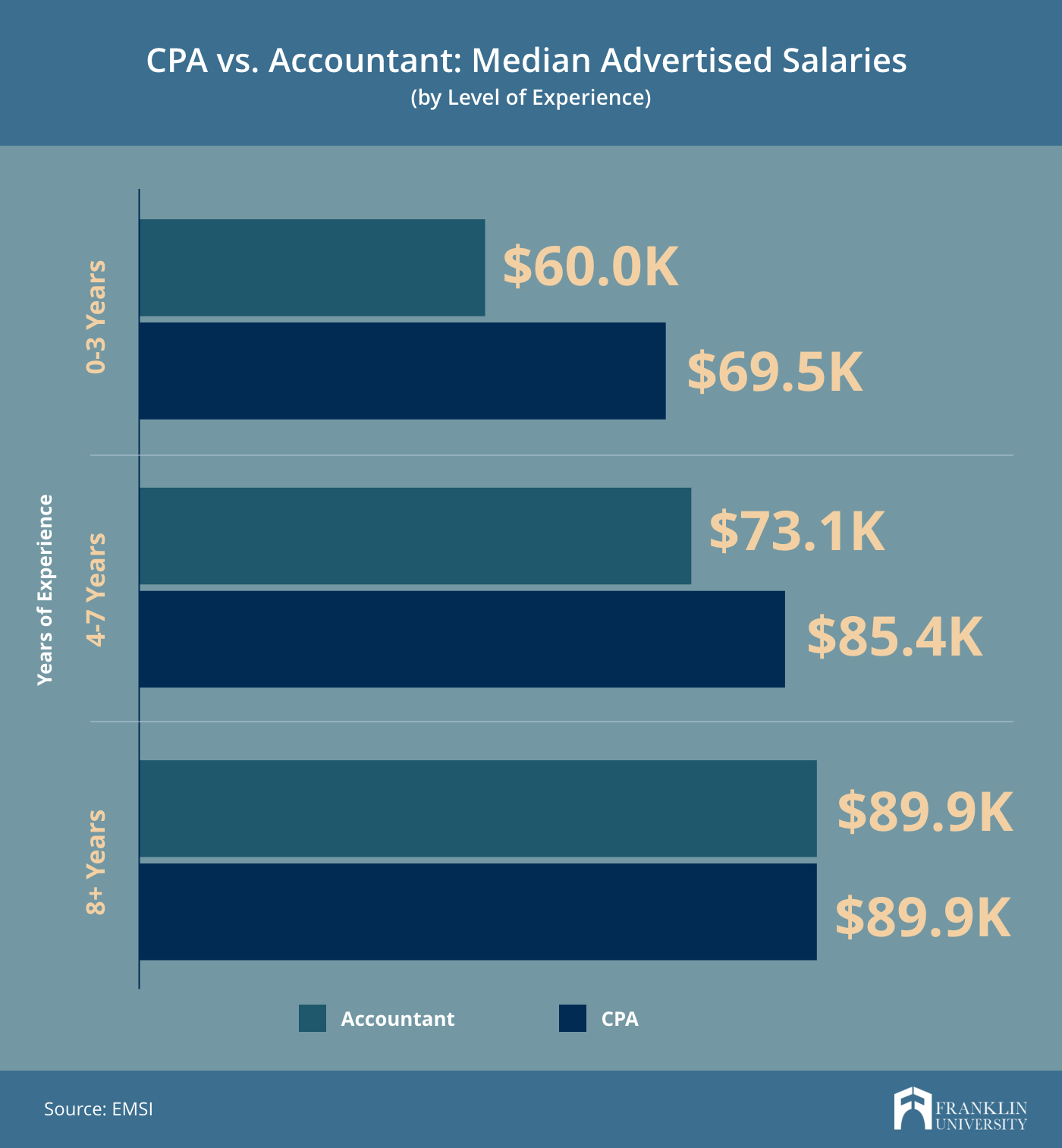

Due to higher educational and CPA credential attainment, CPAs have higher earning expectations than unlicensed accountants.

CPAs are required to complete at least 150 college credit hours to qualify for a CPA license, compared to the standard 120 credits required to earn a bachelor’s degree. Some accounting professionals take advantage of earning a master’s degree in accounting to earn these additional credits, further advancing their credentials in the eyes of employers.

The rigorous requirements of becoming a CPA pay off, as they consistently out-earn unlicensed accountants.

CPA vs. Accountant: Which Role Will Be in Higher Demand in the Future?

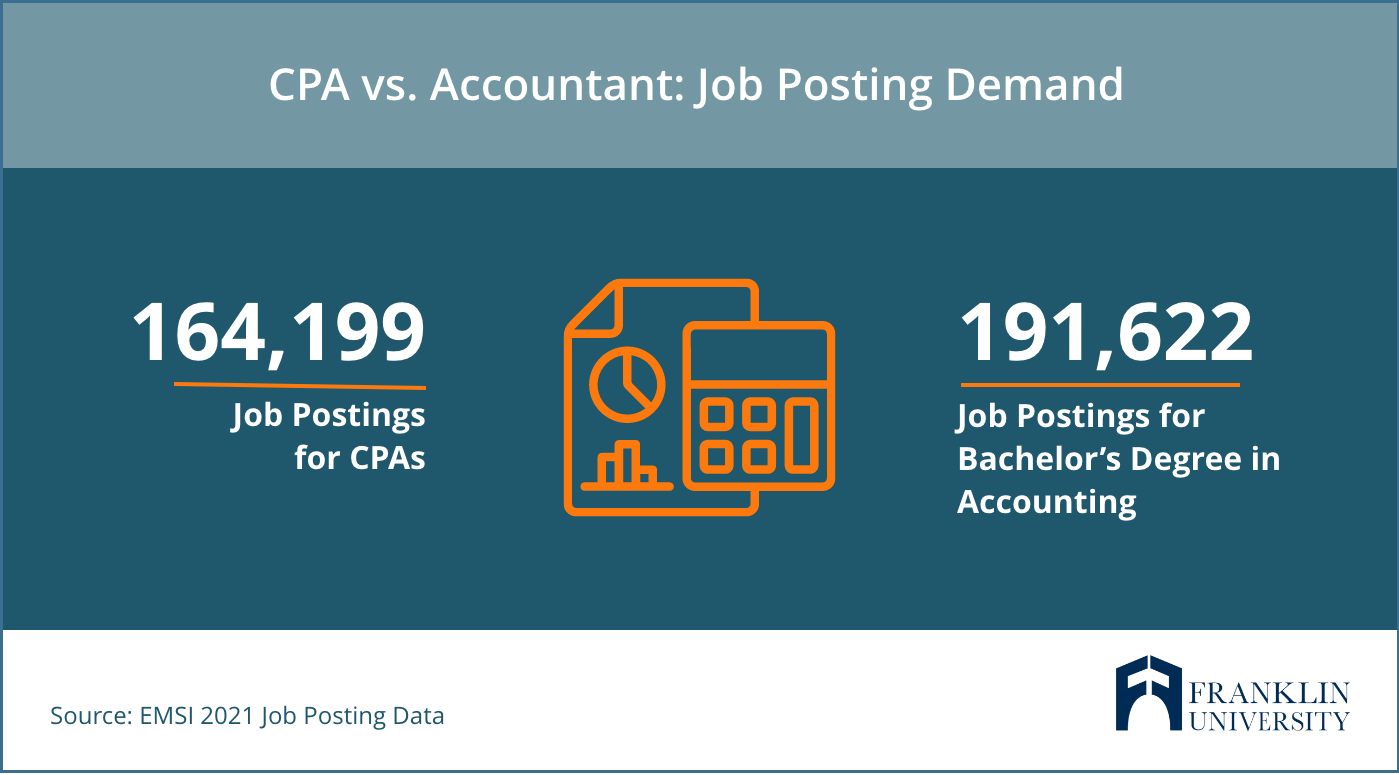

The BLS projects that jobs for all accountants and auditors will grow by 7% by 2030. According to the Bureau of Labor Statistics (BLS), globalization, a growing economy, and a complex tax and regulatory environment are expected to continue to lead to strong demand for accountants and auditors.

Based on EMSI’s aggregated job posting data for 2021, there were 46,626 job postings for accounting professionals that required a CPA. On the other hand, there were 170,607 jobs posted for accountants that only required a bachelor’s degree, not a CPA.

A CPA license won’t disqualify you from any accounting position. Most often, it is seen as a benefit, even when it isn’t necessary for the job.

That means, whether you decide to earn your CPA or not, the future is bright for accountants.

CPA vs. Accountant: How Do The Career Paths Differ?

Many people view accounting as a one-dimensional field. However, there are diverse career paths within the accounting profession.

CPAs are uniquely qualified to work in public accounting firms, which serve multiple clients across industries. These clients may be companies, governments or individuals, depending on the size and type of accounting firm.

As a CPA, you have your choice of firms—from large international firms to small, local accounting practices. CPAs also commonly work in government agencies or public companies required to disclose audited financial information.

CPAs can also provide services in specialized areas of accounting, such as:

- Financial forensics

- Business valuation

- Personal financial planning

- IT consulting

Accountants who don’t earn their CPA typically work in the private accounting field. This means that they work for a single company or organization in its internal finance department. The most popular industries for accountants include finance, insurance, and management of companies and enterprises, as well as self-employment.

Accountants often focus in areas such as:

- Internal auditing

- Management accounting

- Budget analysis

- Tax accounting

Find the Right Accounting Program For You

Whether you’re interested in becoming an accountant or a licensed CPA, the first step is getting your bachelor’s degree in accounting.

Franklin University offers a 100% online bachelor’s degree in accounting designed to help working adults earn their degrees. Franklin’s accounting program teaches industry best-practice skills and the latest accounting technology to help students stand out in a competitive market. The curriculum will also help you prepare for the rigorous CPA exam.

If you already have a bachelor’s degree, Franklin’s master’s degree in accounting can help you reach the required 150 credit hours to sit for the CPA exam. A master’s degree will also add another valuable credential to your résumé that can help you stand out in the marketplace.

Explore Franklin’s M.S. Degree in Accounting to see how it can help put you on the fast-track path to a CPA license.