How Hard is the CPA Exam? Sorting Fact from Fiction

The CPA Exam. You’ve heard the horror stories: It’s derailed the careers of promising professionals. It’s definitely harder than the BAR exam and maybe even some medical board exams. And it’s nearly impossible to pass once you’re a working professional.

But, are any of these anecdotes true? In this article, we’re going to sort fact from fiction and provide you with an honest look at the CPA Exam so you can be better prepared for it.

Keep reading to learn about the exam components, discover how it’s scored, better understand the time commitment it takes and find out how many people actually passed it in 2021. And perhaps most importantly, throughout this article, you’ll find reputable and actionable advice from Sawyer Smith, CPA and senior associate, Assurance at KPMG–one of the Big Four accounting organizations.

Need-to-Know Facts About the CPA Exam

What exactly is the CPA Exam?

Officially called the Uniform CPA Examination (CPA Exam), the CPA Exam is a 16-hour, four-section assessment that professionals must pass to become a Certified Public Accountant (CPA). Each section focuses on a specific area of knowledge or skills that directly aligns with the work newly licensed CPAs will perform. Each exam section is further broken down into small segments called testlets and includes up to three different types of questions. Here’s a breakdown of the exam:

Ready to make your move in accounting? Gain insights for every career stage in our free Accounting Career Guide.

How are the CPA Exam sections scored?

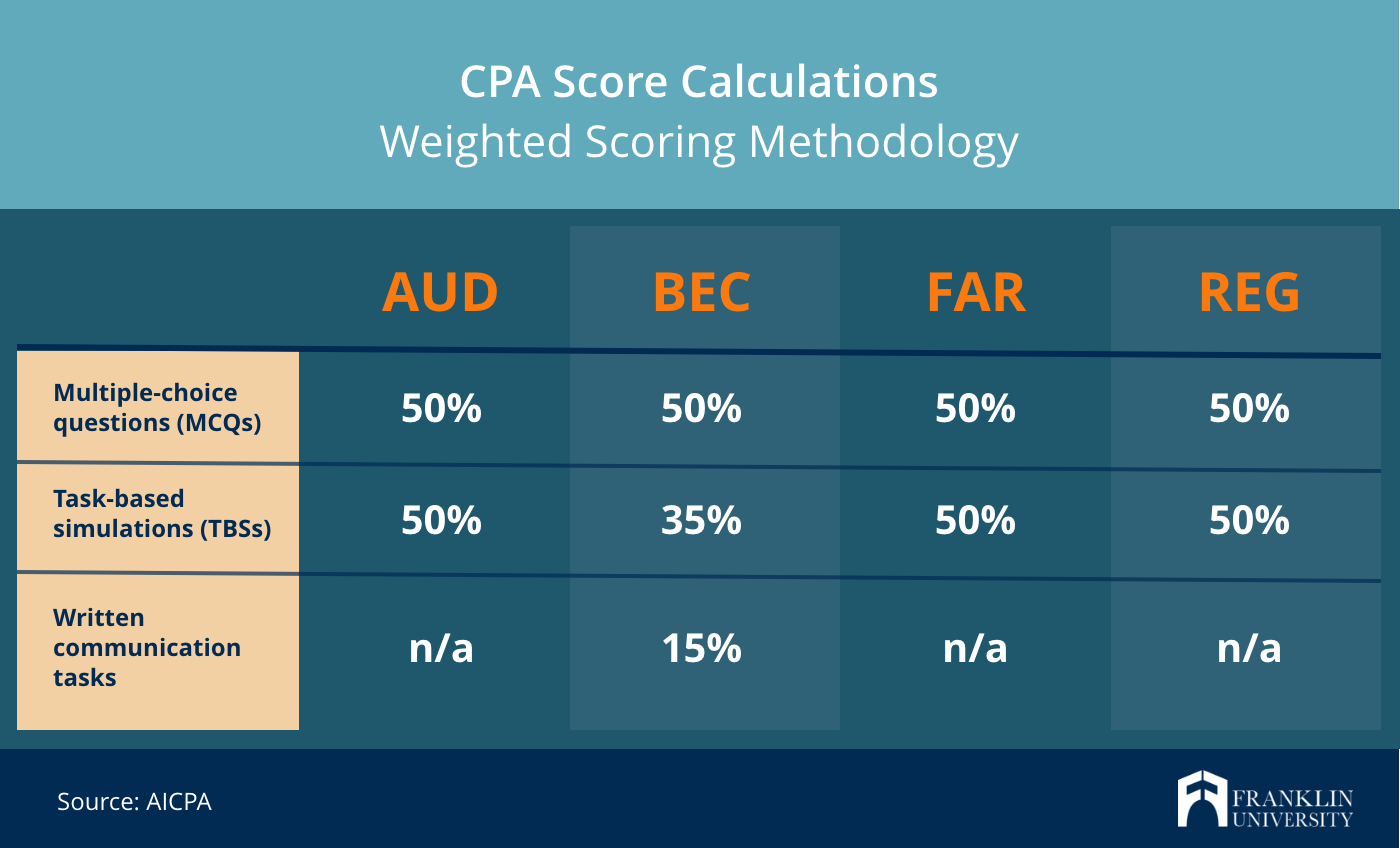

According to the American Institute of CPAs (AICPA)–the world’s largest accounting profession association and the entity responsible for the development and scoring of the CPA Exam–scores are reported on a scale of 0-99.

To pass each section of the exam, you must score a minimum of 75. It’s important to understand that 75 doesn’t represent a percentage of the total questions you must answer correctly because questions are not weighted equally. The diagram below explains how the exam sections and different types of questions are weighted.

For MCQs, the CPA Exam uses a multi-stage adaptive test delivery model that enables test questions to be matched to each candidate’s proficiency levels.

How much time does the exam require?

The CPA Exam is a rigorous test and requires a serious commitment. However, like all tests, the amount of time you dedicate to studying for each section of the exam will depend upon your own knowledge, experience and test-taking abilities.

“Some people study four hours a week and some will study 25 hours,” says Sawyer Smith

senior associate, Assurance (KPMG), CPA. “It truly is the type of test where you get out what you put in. Your exam score will reflect the time and energy you spent preparing for it.”

Well-known preparation companies, such as Becker CPA Review and UWorld Roger CPA Review, recommend candidates spend between 300-500 total hours studying for the full exam. Luckily, you won’t have to cram all those hours of studying into a single month.

“You have 18 months to take all four sections of the exam and even though that seems like a lot of time, you will probably need all of it to be successful,” says Smith. “You need to approach the exam with a strategic plan so that if you don’t pass a section the first time, you have enough time left in that 18th-month testing window to retake it.”

What are the pass rates for each section of the CPA Exam?

Now let’s discuss what’s top of mind for all CPA Exam candidates–passing it. About half of the individuals who take the CPA Exam don’t pass on their first attempt. According to the AICPA, the national average pass rate is 45-55%.

Cumulative pass rates reported by the AICPA for the calendar year 2021 show that FAR had the lowest pass rate at 44.54% and BEC had the highest pass rate at 61.94%.

| Exam Section | Cumulative Pass Rate for 2021 |

|---|---|

| AUD | 47.98% |

| BEC | 61.94% |

| FAR | 44.54% |

| REG | 59.88% |

Source: AICPA: Learn more about CPA Exam scoring and pass rates

“BEC and AUD are generally regarded as the ‘easier’ sections of the exam,” says Smith. “FAR and REG are very difficult. They require a lot of memorization and cover so much information. People usually take these two sections first during their 18-month window in case they have to retake them. And it’s important to remember that it’s not uncommon for people to need to retake them–just look at the pass rates.”

3 Tips for Passing the CPA Exam

The facts in this article have laid out the truth about the CPA Exam: passing is no easy feat but it can be done! In fact, according to the National Association of State Boards of Accountancy (NASBA), 23,407 candidates passed the CPA Exam in 2019. With a solid foundation in accountancy, hard work and dedication, you can join the group of candidates who pass each year.

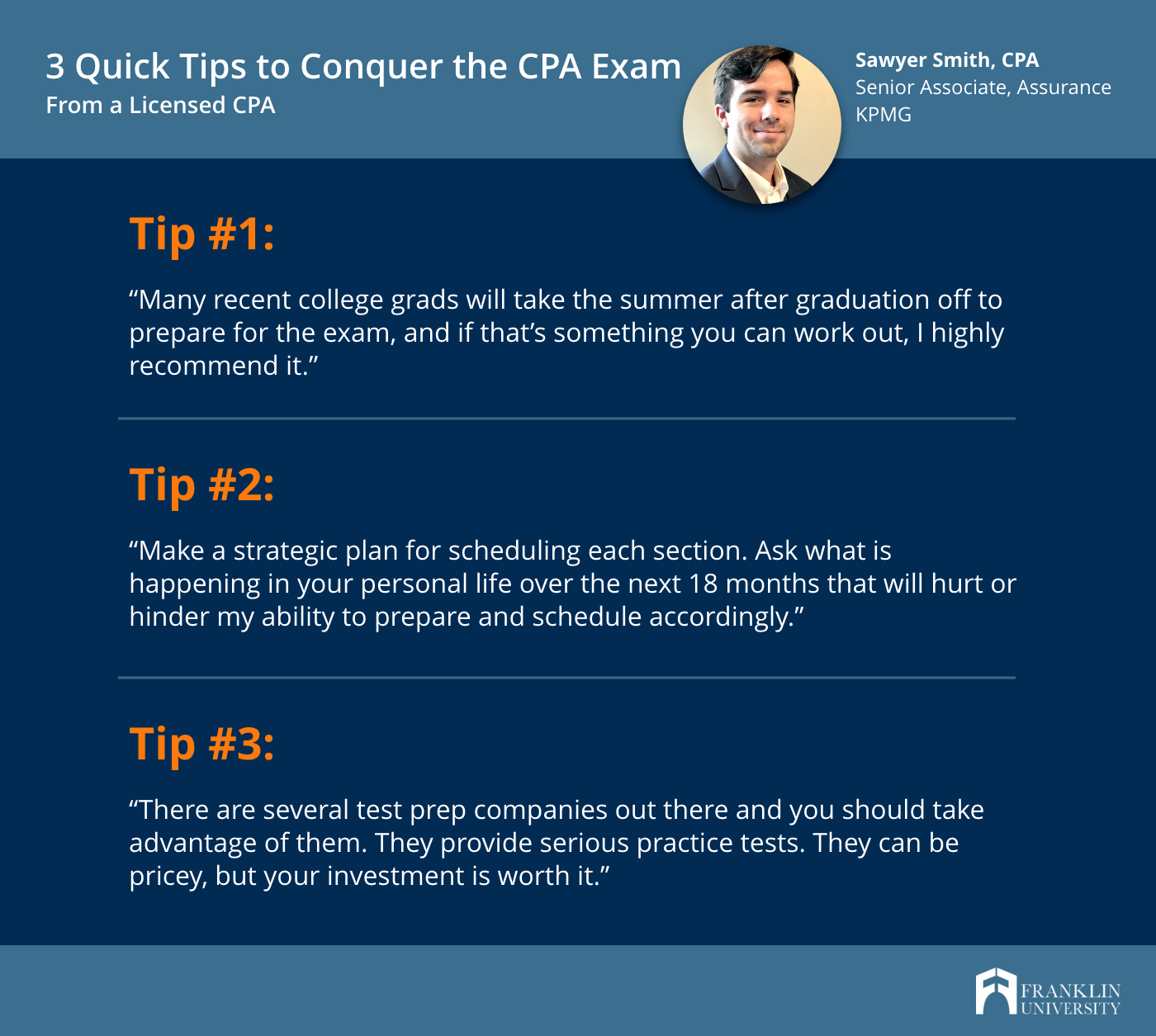

Here are three tips for those who are starting their journey to become a licensed CPA from Sawyer Smith, Senior Associate, Assurance (KPMG), CPA:

- Study and take the exam before entering the workforce.

“I cannot emphasize this tip enough,” says Smith. “Working a full-time job makes studying for and taking the CPA Exam immensely more difficult. After working 40+ hours each week and then trying to carve another 15-25 hours to study can be nearly impossible for professionals with families or other commitments.”

“Some employers have programs in place to support and incentivize employees to earn their CPA license but not all do. Many recent college grads will take the summer after graduation off to prepare for the exam, and if that’s something you can work out, I highly recommend it,” adds Smith. - Do not study and prepare for this exam on your own.

“There are several test prep companies out there and you should take advantage of them,” says Smith. “They provide serious practice tests that will familiarize you with the exam content and format and can also help you get an idea of how to manage your time for the actual exam. They can be pricey, but your investment is worth it when you receive a passing score for all four sections of the exam.” - Be strategic about studying for and taking the exam.

“In addition to knowing the content and understanding the exam format and scoring, you need to make a strategic plan for scheduling each section,” says Smith. “Once you have chosen a testing center and you know the dates they will offer testing for each section you can begin creating your study schedule.”

Here are some questions Smith recommends you ask yourself when thinking about your exam schedule:

- “What section will be easiest for me? What topics do I have the most knowledge about?”

- “What is happening in my personal life over the next 18 months that will hurt or hinder my ability to prepare?”

- “Do I have any buffer time built into my schedule to account for unexpected situations in life and work?”

- “In what order should I take each exam section?”

- “Do I want to take the harder sections or the easier sections first?”

The answers to these questions will help you create a strategic exam schedule that will better set you up for success.

Build a Solid Foundation for Your CPA Licensure Journey

Pursuing your CPA licensure begins by acquiring a solid accountancy foundation through a bachelor’s degree. While it’s not required for your degree to be in accounting, it is highly recommended.

Franklin University provides a flexible B.S. in Accounting program built for working professionals. Courses are taught by faculty members who have deep accounting expertise. Many are licensed CPAs and have years of experience in the field.

Adding a graduate degree to your educational foundation may also be a smart move for CPA candidates–as some studies have shown it may boost your chances of passing the CPA exam. The CPA Journal reports that first-time test takers with master’s degrees have higher pass rates than candidates with a bachelor’s degree. The data reveals that the average pass rate for test-takers with a graduate degree is 58.3%. For those with only a bachelor’s degree, the rate is 48.8%

Getting a graduate degree may be a good choice for your CPA career. Franklin University’s online M.S. in Accounting degree program can help develop your leadership and career skills while you master the technician and non-technical aspects of accounting.