Master’s in Accounting vs. CPA: Differences & Benefits You Need To Know

A master’s degree in accounting and a CPA license can both be professional gamechangers. Choosing whether to pursue these credentials isn’t necessarily an either/or situation. Both of these credentials are highly-sought after, but there are distinct differences and benefits unique to each of them.

From August 2020 to August 2021, there were 103,788 unique job postings seeking accountants and auditors who are licensed CPAs. In that same time period, there were 85,378 job postings seeking accountants and auditors with master’s degrees. There is no shortage of opportunities for professionals with either credential.

How do you know which credential is right for you? Let’s break down the benefits of a master’s degree in accounting vs. a CPA.

Do I Need a Master’s Degree or a CPA?

This is a hard question to answer, because a master’s degree and a CPA license are such different credentials.

- An M.S. in Accounting is a graduate degree that is conferred by an accredited university by successfully completing the required credit hours to graduate.

- A CPA is a professional license that requires meeting education and experience requirements, as well as passing an exam, and is administered and maintained by the American Institute of Certified Public Accountants (AICPA).

Ready to make your move in accounting? Gain insights for every career stage in our free Accounting Career Guide.

It’s common for accountants to pursue either of these paths, and many will pursue both during their career. Which credential you should earn depends on your current professional role and desired career trajectory.

A CPA license is essential for advancement in public accounting. If you want to work for one of the Big 4 public accounting firms—Deloitte, Ernst & Young, PwC or KPMG—you will need to earn your CPA to advance past the senior level.

If you want to work as an industry accountant—or work for a single company or organization—a CPA may or may not be necessary (it depends on your industry and specialization). However, a master’s degree is a lifetime credential that is valued across industries and can be influential in helping you climb the corporate ladder.

Let’s look at the distinct benefits to help you determine which path is right for you.

Getting a master’s degree in accounting takes time and dedication. Before diving into a degree program, you may be wondering if it’s truly worthwhile to get your master’s degree in accounting. Let’s look at four of the most compelling reasons to earn your master’s degree.

- A master’s degree is a lifetime credential: There are no renewal requirements or continuing education—a master’s degree is a permanent credential. The time, energy and money you invest in getting a master’s degree will always have value.

- A master’s degree will give you specialized skills: While an undergraduate degree teaches you the fundamentals, a master’s degree in accounting allows you to deepen your knowledge and gain specialized skills. You can choose a focus area, such as taxation or financial operations, to improve your job prospects within that specialty. You also have the opportunity to gain a more diverse skillset in areas such as data analysis and information systems that can set you apart from other qualified professionals.

- A master’s degree promotes upward mobility: Many employers are seeking master’s degree candidates to fill leadership roles. According to labor marketing analytics first EMSI, from August 2020 to August 2021, 85,377 jobs were posted for accountants and auditors with a master's degree. By investing in your education, you will open the door to advancement opportunities at the highest levels of leadership.

- A master’s degree provides numerous networking opportunities: If you choose a program designed for working adults, getting your master’s degree provides an opportunity to network with other dedicated and driven peers in the accounting field. This experience can also connect you with faculty who have deep ties to the industry and employers. Universities may also offer access to mentorship opportunities or professional organizations.

4 Benefits of Becoming a CPA

Becoming a CPA is a major professional accomplishment within the accounting profession. CPAs are held in high regard for their knowledge, skills and commitment. If you’re wondering if you would benefit from becoming a CPA, consider these advantages.

- A CPA license is considered very prestigious: The CPA license is the most widely recognized professional credential in the accounting industry. It distinguishes accounting professionals for accounting expertise, best-practice skills and upstanding ethics.

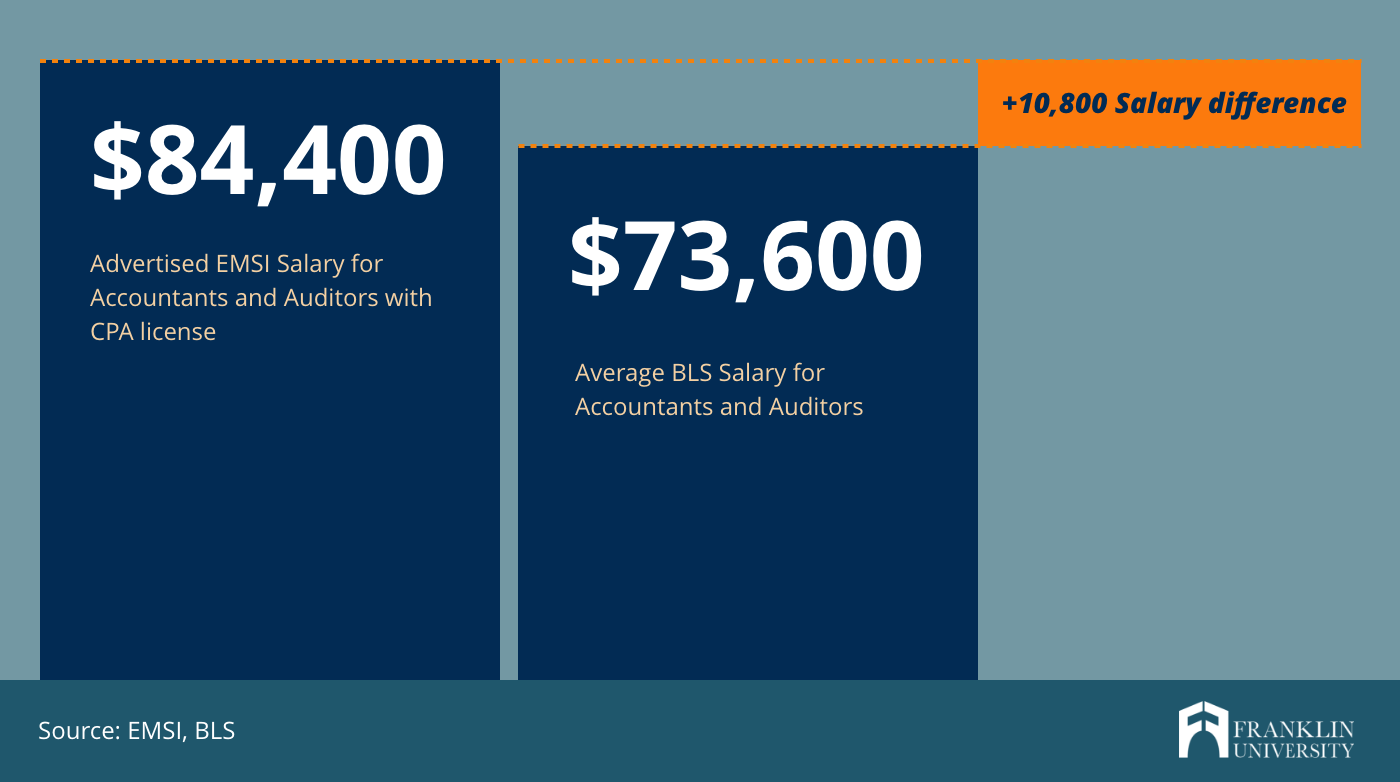

- A CPA license correlates with higher salaries: According to EMSI, the median advertised salary for accountants and auditors with a CPA license is $84,400. That’s $10,800 more than the occupation average for Accountants and auditors stated by the Bureau of Labor Statistics.

- Employers seek out professionals who are CPAs: From August 2020 to August 2021, EMSI reported 103,838 job postings for accountants and auditors with a CPA license. This demand is indicative of the large job market for accountants with a CPA license. This is especially true if you want to work for a public accounting firm, where a CPA is essential for advancing past the entry level.

- A CPA shows dedication to maintaining professional excellence. Getting a CPA license isn’t the final step. Once you have earned your CPA license, you must complete continuing education requirements in order to maintain your credential. This commitment shows employers that you not only understand the fundamentals, but will continue to stay at the forefront of the accounting field.

Do I Need Both a Master’s in Accounting and a CPA?

There are many reasons to pursue both a master’s degree in accounting and a CPA license. Here are three of the most compelling.

- A master’s degree helps you meet the requirements to sit for the CPA exam. CPA requirements vary state by state. However, all states require earning 150 college credit hours before you can sit for the CPA exam. Most bachelor’s degrees only require 120 credit hours to graduate. You can make up that 30 hour gap while gaining an additional credential and a deeper skillset.

- They’re complementary professional credentials. A master’s degree in accounting and a CPA license are not competing credentials. These designations provide different benefits and signify different qualities to a prospective employer. While a CPA shows mastery in foundational accounting skills, a master’s degree shows you’re driven to gain new skills that will directly benefit an organization.

- The combination can help you stand out from the crowd. Accounting positions, especially at top public accounting firms, can be incredibly competitive. It’s essential to find ways to stand out—on your resume, during job interviews and on the job. A CPA will immediately signal that you are a top-tier accountant, while a master’s degree can showcase leadership potential and cutting-edge skills in complementary areas such as data analysis.

Your individual career goals will ultimately determine whether you should earn both a master’s degree and a CPA license. If these benefits sound like they align with your career trajectory, you need to find a master’s degree in accounting program that will help you achieve your aspirations.

Find The Right Master’s Degree in Accounting to Meet Your Career Goals

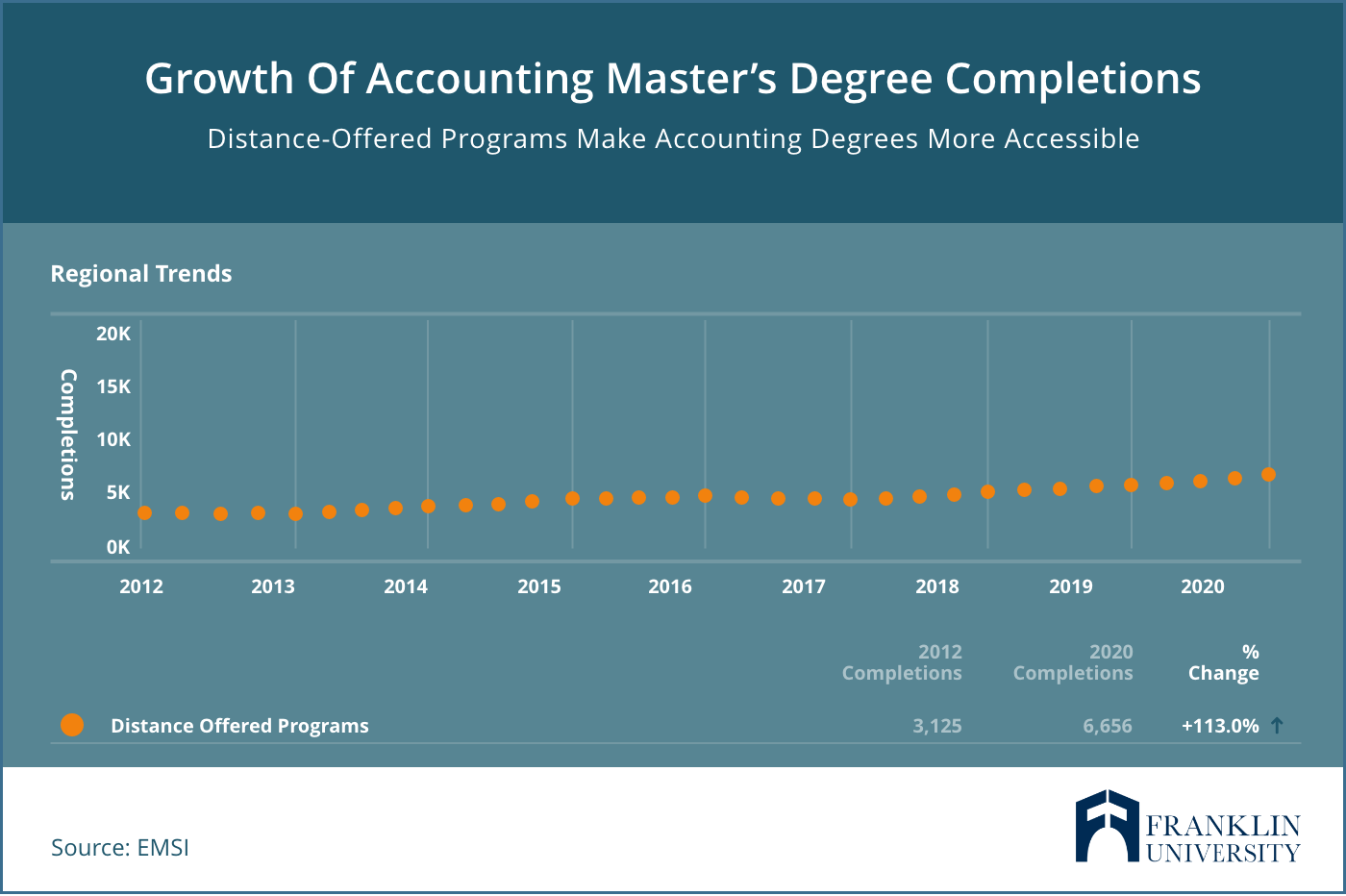

Franklin University offers a 100% online M.S. in Accounting degree that will help you accelerate your career. This degree program can give you a specialized skill set that will help you stand out among other professionals, while also preparing you to sit for the CPA exam. Franklin’s IACBE-accredited program aligns with business best practice standards and all courses are taught by professionals with extensive industry experience.

See how the Franklin M.S. in Accounting program can help you earn your master’s degree and jumpstart your career advancement.