Request Information

We're Sorry

There was an unexpected error with the form (your web browser was unable to retrieve some required data from our servers). This kind of error may occur if you have temporarily lost your internet connection. If you're able to verify that your internet connection is stable and the error persists, the Franklin University Help Desk is available to assist you at helpdesk@franklin.edu, 614.947.6682 (local), or 1.866.435.7006 (toll free).

Just a moment while we process your submission.

How Does Financial Aid Work?

There’s no doubt about it – college is expensive.

But the published “sticker price” you see on a college’s website doesn’t tell the whole story. According to the College Board, 78% of students at public four-year institutions and 88% of students at private nonprofit four-year institutions receive financial aid, which can significantly cut the cost of a degree.

Here’s what you should know about how financial aid works, how to access it and what it can mean for you.

What Is Financial Aid?

Financial aid is a broad term for outside funding that helps college and university students pay for their studies. In other words, financial aid is money that goes toward the cost of your degree but doesn’t come out of your pocket.

The term usually refers to funding that a college or university offers an accepted or enrolled student. Known as an “aid package,” this funding can include everything from federal, state and private grants to scholarships, student loans and work-study. Financial aid offers are calculated based on the estimated total cost of earning a degree. That means that you can use these funds to cover expenses like living costs, textbooks and supplies in addition to tuition and fees.

Financial aid can be either need-based or merit-based, and many financial aid packages include both types of aid.

Need-based financial aid is awarded to students who don’t have the financial resources to pay full price for their degrees. It can be offered by federal, state and local governments or by colleges and universities.

Merit-based aid is awarded based on factors like academic performance and may be offered by colleges and universities.

Note that financial aid award letters offered by a school do not typically include funding sources like employer tuition reimbursement or scholarships offered by outside organizations. However, outside funding does need to be reported to the school, since it can impact your eligibility for funding from other sources.

Who Is Financial Aid For?

Financial aid bridges the gap between the cost of college and students’ financial resources. Despite what you might assume, financial aid isn’t just for traditional, first-time college students. There are no age restrictions, and anyone can apply for federal financial aid as long as they meet basic qualifications. Your ultimate eligibility will depend on your personal financial situation and other factors.

To be eligible to apply for federal financial aid, you must:

- Hold a high school diploma or the equivalent (such as a GED).

- Be accepted into an eligible degree program (you can and should apply for aid prior to being accepted).

- Have a valid Social Security number

- Be a U.S. citizen or qualified noncitizen (this includes individuals with green cards and certain types of visas).

- Complete the Free Application for Federal Student Aid (FAFSA)

If you receive financial aid, you’ll reapply each year to continue receiving funds. Check with your school to find out when the award year starts, as it can differ between institutions. To remain eligible, you will need to maintain satisfactory academic progress. Some types of aid are only available to students enrolled at least half-time.

When it comes to paying for school, grants are among your best options. But do you know how to find them? Remove the guesswork by downloading this free guide

What Types of Financial Aid Are Available?

Financial aid packages can include several different types of funding depending on your eligibility. These include:

Federal grants

The federal government offers Pell Grants and Federal Supplemental Educational Opportunity Grants to undergraduate students based solely on financial need. These grants are not loans and do not have to be repaid.

Additional federal grant programs are available to students who meet certain qualifications (for example, completing military service or committing to teach in underresourced public schools for a certain number of years).

Institutional grants

Some colleges and universities offer additional grants for students whose financial need exceeds what federal grants can cover. Funding for these grants often comes from the generosity of the school’s alumni.

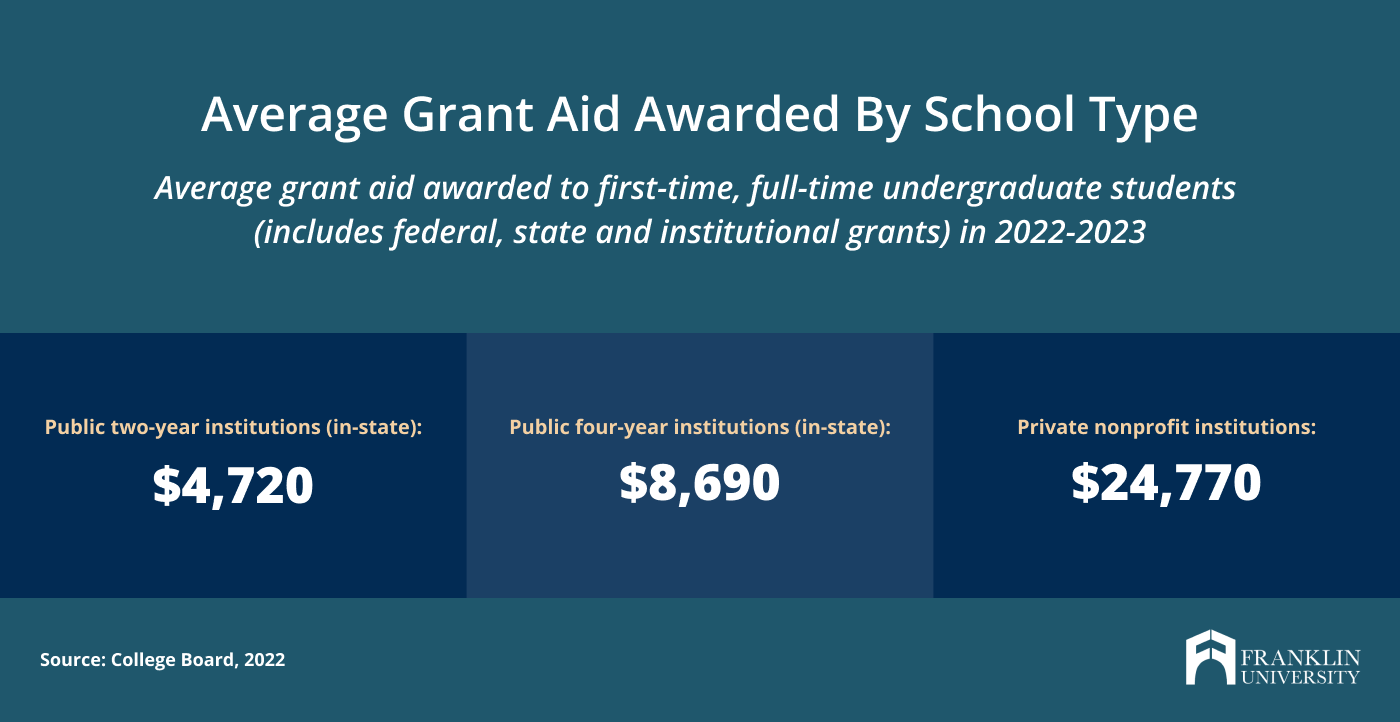

Often, private colleges have more grant funding available than public institutions. This means that even if their advertised price is higher, a private college may ultimately be more affordable than a public school for some students.

State grants

Most state education agencies also offer grants for students with financial need. Many of these grants can only be used to attend in-state schools. For example, Franklin University, which is located in Ohio, can only offer state grants to residents of Ohio and Pennsylvania. Some states also offer targeted grants for students from specific backgrounds.

Check your state’s Department of Education website to learn more about grant options and eligibility.

Federal work-study

Federal work-study is funding offered in exchange for a commitment to work a certain number of hours at a specified rate for your school or for an eligible nonprofit or public sector organization in your area. Participating students are paid directly by their schools.

Scholarships

Some schools may include scholarships based on merit (your academic or professional achievements) or other factors, like belonging to a specific racial or ethnic group, in their financial aid packages.

Other scholarships may be offered by entities outside of your institution. However, you must report any scholarships you receive to your school, as they may impact your aid eligibility.

Student loans

Like car loans or personal loans, student loans ultimately need to be repaid to the lender, which may be the federal government or a private financial institution.

Student loans included in a financial aid package are most often federal loans, but you should review the terms of any loans you are offered carefully. Timelines, interest rates and requirements can vary significantly between loan types and between federal and private loans.

How Do You Get Financial Aid?

Applying for financial aid is a more streamlined process than you might think. Here are the steps to apply using the Free Application for Federal Student Aid (FAFSA), which the government and universities use to establish your eligibility for funding.

1. Mark the next FAFSA priority deadline on your calendar

While the FAFSA is accepted on a rolling basis, each school and state sets its own priority deadlines. Apply by those dates to give yourself the best chance of receiving as much aid as possible since some types of funding are limited.

2. Determine your dependency status

Your dependency status determines whether or not your parents’ information should be included in your financial aid application. It’s a purely legal question that doesn’t have to do with how much actual support your family offers you. You can determine whether you are a dependent or independent student using criteria set by the U.S. Department of Education.

If you are classed as a dependent student, you will also have to submit your parents’ financial information when applying for financial aid, whether or not they plan to contribute to the cost of your degree.

3. Gather key documentation

Collect the information required to complete the FAFSA early to avoid a last-minute scramble. You’ll need your Social Security number and driver’s license (if you have one), your most recent federal tax return, records of any untaxed income (like child support), and documentation of all of your assets, including cash, savings or checking accounts and any investments or business assets. Do not include information about retirement or health savings accounts.

If you’re classed as a dependent student, you’ll also need to submit this information for your parents, and if you’re married, you will need your spouse’s tax records.

4. Create a Federal Student Aid (FSA) ID

To file your FAFSA, you’ll need an online account called an FSA ID. If you are a dependent student, your parent must also create their own. Getting your ID before starting the FAFSA can help reduce errors and delays. Just be sure to make a note of your password!

5. Complete and submit your FAFSA forms

It’s easiest (and safest) to complete the FAFSA form online. To make things easier, you can consent to link your account with IRS databases to automatically fill in some information from your taxes, though it’s important to check against your records.

To send your FAFSA to the schools you’re applying to, include their federal codes on the application. You can find a list of school codes through the U.S. Department of Education or by looking at each school’s financial aid page.

6. Review your Student Aid Report (SAR)

About two weeks after you submit your FAFSA, you’ll receive an email notification that your SAR is available on the FAFSA website. Check for any errors in your personal information and update your information if anything has changed since you filed your FAFSA.

The SAR will not show you the aid you could receive. Instead, it will be sent on to the schools you selected on the FAFSA for use in calculating your aid offers.

7. Receive and review financial aid offers

Each school you’re accepted to will send you a separate financial aid offer – timelines differ by institution.

Compare each aid offer against the school’s tuition and fees to see how much is covered. If you’re looking for in-person degree programs, it’s also important to consider how your living expenses might vary. Remember that all financial aid isn’t the same. Don’t just look at the total number; check how much aid comes from loans versus grants.

8. Accept an aid offer and finalize documentation

Sign the offer you’ve chosen and follow the school’s instructions to ensure you’re fully enrolled. If you accept student loans, you must sign a legal document called a Master Promissory Note and complete online loan entrance counseling at this time.

Learn More About Franklin’s Affordable Degree Options

Franklin University is committed to affordability and offers competitive tuition, flexible scheduling and online options to help you minimize the cost of your degree.

For bachelor’s and master’s degree students, your tuition rate is locked in the moment you enroll, meaning that you won’t be subject to any cost increases, and you can calculate the total price of your degree from the start. Plus, Franklin’s generous transfer policies also make it easy to carry over credits you earned elsewhere, meaning you won’t have to pay extra to retake those courses.

Learn more about tuition and financial aid at Franklin.