Request Information

We're Sorry

There was an unexpected error with the form (your web browser was unable to retrieve some required data from our servers). This kind of error may occur if you have temporarily lost your internet connection. If you're able to verify that your internet connection is stable and the error persists, the Franklin University Help Desk is available to assist you at helpdesk@franklin.edu, 614.947.6682 (local), or 1.866.435.7006 (toll free).

Just a moment while we process your submission.

How Much Does a Bachelor’s Degree Cost?

For many prospective college students, the cost of a degree is a major concern – and for good reason.

Between 1980 and 2021, the average college tuition charged for a bachelor’s degree nearly tripled, even after factoring in inflation.

But before you panic, read on. Averages don’t tell the whole story. Earning a college degree can be much more affordable than you might think, especially if you know the tips and tricks to leverage.

How Much Does It Cost to Get a Bachelor’s Degree?

According to the College Board, the average published tuition and fees for full-time undergraduates enrolled in a four-year program in the 2022-2023 school year ranged from $10,940 for in-state students at a public institution to $39,400 at a private university.

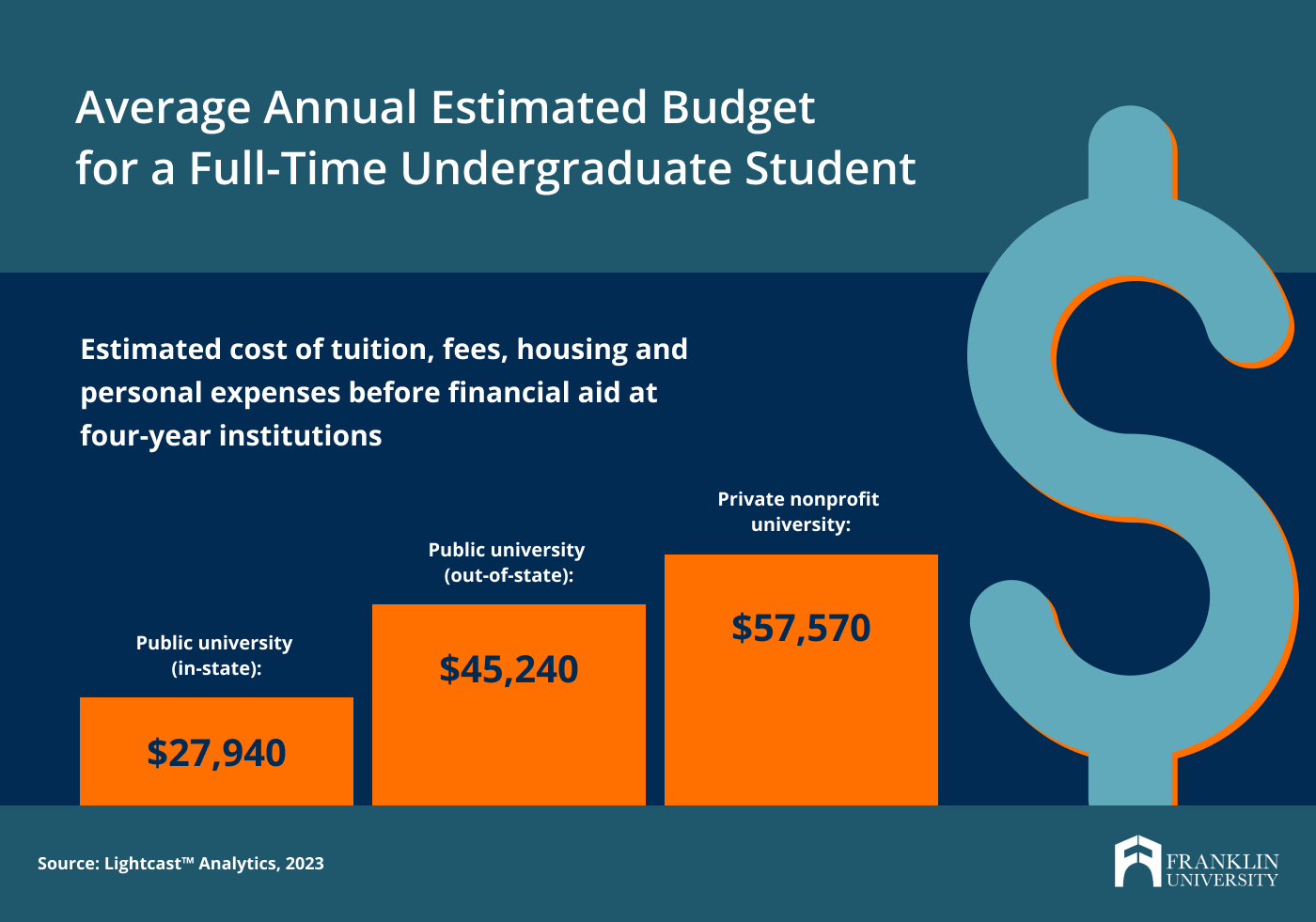

However, those published tuition and fee figures are sometimes just the tip of the iceberg since they don’t include additional costs like housing and transportation. That’s why, in addition to publishing their tuition and fees, most colleges post average estimated budgets or costs of attendance, which include tuition and fees, room and board, transportation, books and other personal expenses. For many students, this figure is a more accurate estimate of what a degree will actually cost.

In the 2022-2023 school year, estimated annual budgets for full-time undergraduate students at four-year institutions ranged from $27,940 for public four-year in-state students to $45,240 for out-of-state students at public four-year schools and $57,570 for students at private, nonprofit four-year schools.

Remember that public school tuition and fees vary significantly between states, so be sure to explore your state’s rates and residency requirements when estimating costs.

What’s the Difference Between “Sticker Price” and “Net Price” for College?

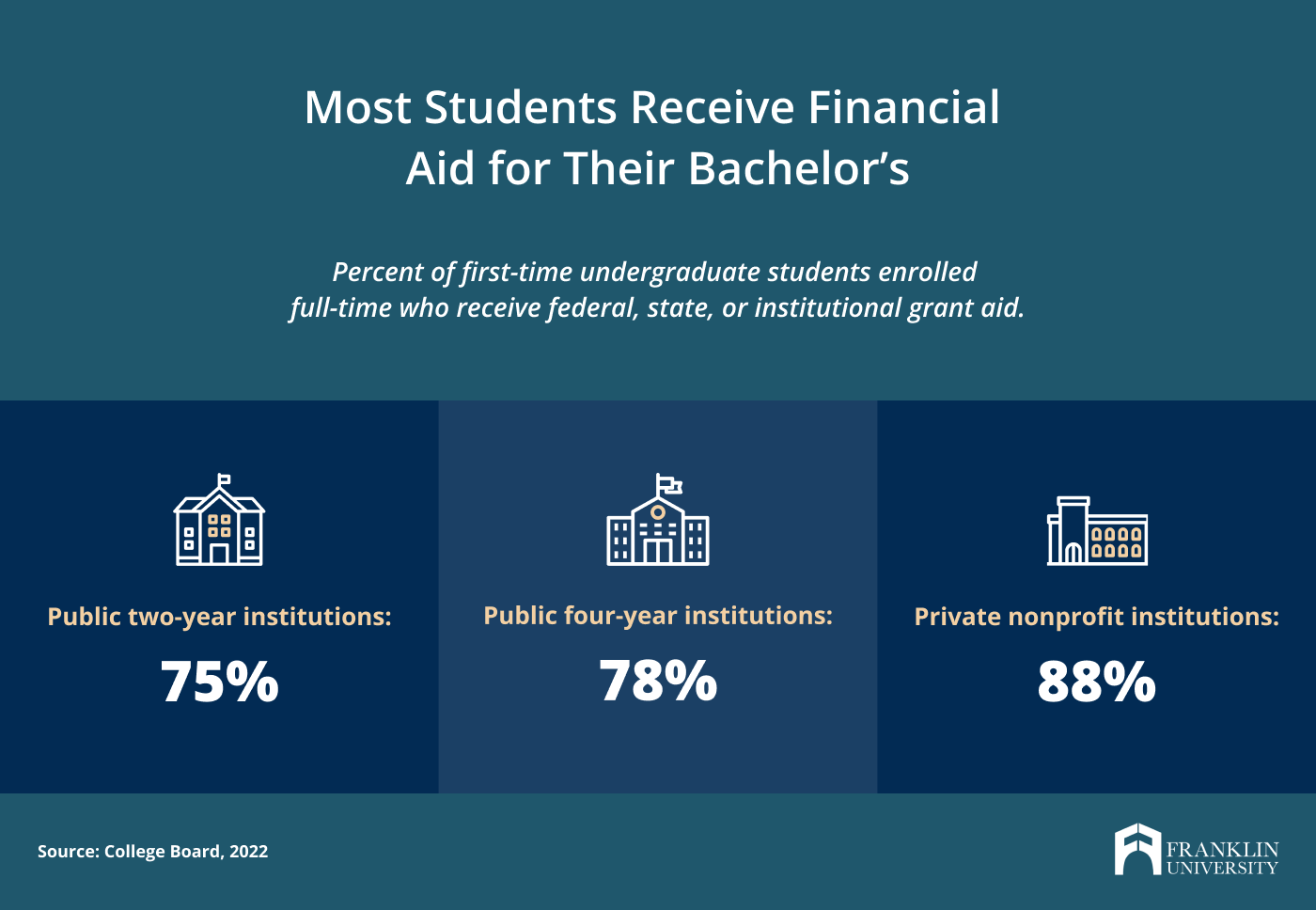

While those “sticker” prices can seem shocking, it’s important to understand that the “net price” you pay after financial aid and scholarships may be much lower. According to the College Board, 78% of students at public four-year institutions and 88% of students at private nonprofit four-year institutions received federal, state, or institutional grant aid (this data is based on students enrolled in college full time and for the first time, though other students are also eligible for aid). Grant aid, unlike loans, does not need to be repaid, which means that these students are effectively receiving a discount on their education.

If you apply for financial aid, each school that accepts you will offer a financial aid “package,” which you can use to determine what your net price of attendance will be. Since financial aid offers vary quite a bit, it’s wise to consider a range of colleges, even those that may appear more expensive initially. Those schools often have larger budgets for scholarships and grants, which means they may be more affordable than institutions with lower published rates.

When it comes to paying for school, grants are among your best options. But do you know how to find them? Remove the guesswork by downloading this free guide

What Factors Impact the Price of a College Degree?

Many factors contribute to the price differences between institutions.

1. Public vs. private school

On average, published tuition rates at public colleges and universities are lower than at private universities – especially for in-state students. However, those advertised prices can be deceiving. Many private schools can offer more scholarships and financial aid than their public counterparts, and a higher percentage of students attending private schools receive grant funding.

2. Level of college “amenities”

Some schools invest heavily in on-campus amenities and programs – everything from lazy rivers to arts programs – that significantly drive up tuition. If that’s something you value, the extra cost may be worth it. But if it isn’t, trying to avoid those costs makes sense.

“Even if you're not living on campus, sometimes the cost of those facilities and programs are built into that tuition,” said Whitney Dodds, undergraduate admissions team lead at Franklin University. “While you’re not paying room and board, part of your tuition might cover the gym facility that you may or may not use or resident life activities that you may not be taking advantage of.”

3. Online vs. in-person

At many universities that are primarily brick and mortar, online and in-person tuition are charged at the same rates because schools have to pay for facilities upkeep and programming for on-campus students. Some schools even charge higher tuition for online courses.

However, universities that offer primarily online or hybrid programs, like Franklin University, often have significantly less expensive tuition because they don’t have those types of facilities and the associated maintenance expenses. If you enroll in one of these programs, you’ll know that your tuition dollars are going toward the cost of your education, not the cost of your classmates’ extracurricular activities.

4. Tenured vs. adjunct faculty

Different types of universities use different faculty employment models, which can significantly impact costs. Some primarily employ full-time, tenured academics, while other institutions, like Franklin University, mostly hire professionals who are experts in their fields to teach courses on an adjunct basis.

When looking at schools, Dodds said, "Consider how much of their faculty is full-time and tenured. While that may provide a certain set of opportunities, it's also really expensive. If you're looking at an institution that does have more adjunct faculty on staff, not only are those folks less expensive to the university, but they’re also typically working in the industry that they’re teaching classes on, so they’re up-to-date on the topics that are most relevant to students.”

How Can You Reduce the Cost of Your College Degree?

Understanding what drives college costs can help you find less expensive options. However, no matter where you enroll, you can still take steps to reduce your total costs.

1. Apply for financial aid

The vast majority of students receive at least some financial aid, which can include federal, state and institutional grants, loans and work-study. To apply, you’ll submit the Free Application for Federal Student Aid (FAFSA), which is administered by the U.S. Department of Education. The application is used to determine your financial need and asks about your income and assets (and potentially your family’s, depending on your situation).

2. Apply for scholarships

Scholarships are funding offered to students based on things like their academic performance in high school, their life experiences or belonging to particular communities. That means you may be eligible for a wide variety of scholarships. Franklin University offers a streamlined scholarship application process as part of the admission application that allows you to check off the scholarships that you are eligible for and does not require multiple applications.

3. Transfer credits from advanced high school courses or community college

Some students may be able to apply credits from coursework they completed in high school, such as Advanced Placement (AP) classes, to their college degrees. Others may find that completing general education classes at a community college before transferring to a four-year program makes financial sense. If you’re interested in pursuing this route, be sure to examine each school’s credit transfer policy and requirements carefully. While some schools, like Franklin, take a liberal approach to accepting transfer credits, others may accept few or no credits from other institutions.

4. Plan to graduate as quickly as possible

In 2020, the U.S. government found that only 64% of undergraduates who had started degree programs in 2014 had finished their degrees within six years. Less than half of bachelor’s degree recipients finish their degrees in 48 months (four years) or less.

If you are enrolled in programs that charge by credit, taking longer to complete your degree may not increase your costs. However, additional time can directly translate to additional dollars if you study at a school that charges per semester or year.

5. Minimize room and board and transportation costs.

For many students, living off-campus is more cost-effective than campus housing, especially if good public transportation is available in the area. However, moving to a new area can still come with added expense. To cut costs even further, consider taking online courses, which eliminate the cost of transportation and potential relocation.

6. Work while you study

Consider programs that offer enough flexibility to keep working while studying. Even if you only earn enough to cover part of your tuition or living expenses, you can significantly reduce the amount of loans you may need to take out to complete your degree.

While this can be difficult because of class schedules at many traditional institutions, schools that cater to adult and returning learners tend to be designed with working students in mind. Franklin’s programs, for example, are primarily asynchronous, and classes and meetings that take place synchronously are usually in the evenings.

How Can You Decide if a Bachelor’s Degree Is Worth It?

Deciding whether or not to get a bachelor’s degree is a highly personal choice. However, thinking through your potential costs and benefits can help you find the best path forward.

Consider the types of jobs and salaries you’d like and look up job postings for those positions. Do those jobs require (or prefer) a bachelor’s degree? If they don’t, will your advancement in your field be capped without a degree? Entering certain industries without a degree may be possible, but you may find that you still need a degree to move into management positions.

You should also think about how a degree could impact your earnings and expenses. Calculate your expected salary with a degree minus loan payments and compare that to what you would make without a degree (and without loans). Remember that you will likely work for many years after you pay off your loans, and the impact of a higher salary can compound significantly over time.

Explore Affordable Bachelor’s Degree Options

If you’re looking for affordable bachelor’s degree options that work for you, Franklin University may be a good fit. Franklin’s programs are primarily offered online and asynchronously, significantly reducing the cost of a degree.

In addition to offering competitive tuition of $398 per credit hour, Franklin works to help students access scholarships, grants and other forms of financial assistance. Plus, Franklin’s tuition guarantee means that as long as you remain enrolled full-time, your tuition rate will not increase, saving you from unpleasant surprises.

Learn more about the cost of a degree at Franklin.