Why and How Do I Become a Certified Public Accountant (CPA)?

Becoming a certified public accountant, or CPA, is a challenging but worthwhile endeavor. For many students interested in accounting, getting a CPA license is the ultimate goal. It takes time, dedication and perseverance, but can ultimately lead to increased job prospects and security, a higher salary and a multitude of advancement opportunities.

Why Should I Become a CPA Instead of a Non-Certified Accountant?

As the financial industry evolves—thanks to global opportunities, ever-changing regulatory requirements and complex business acquisitions—both businesses and the government need exceptional accounting professionals. A CPA license is the industry-standard for ensuring accounting professionals have the education and experience to uphold the highest financial and ethical standards.

But what’s the difference between an accountant with and without a CPA? Here’s a quick overview of the distinctions between these two roles.

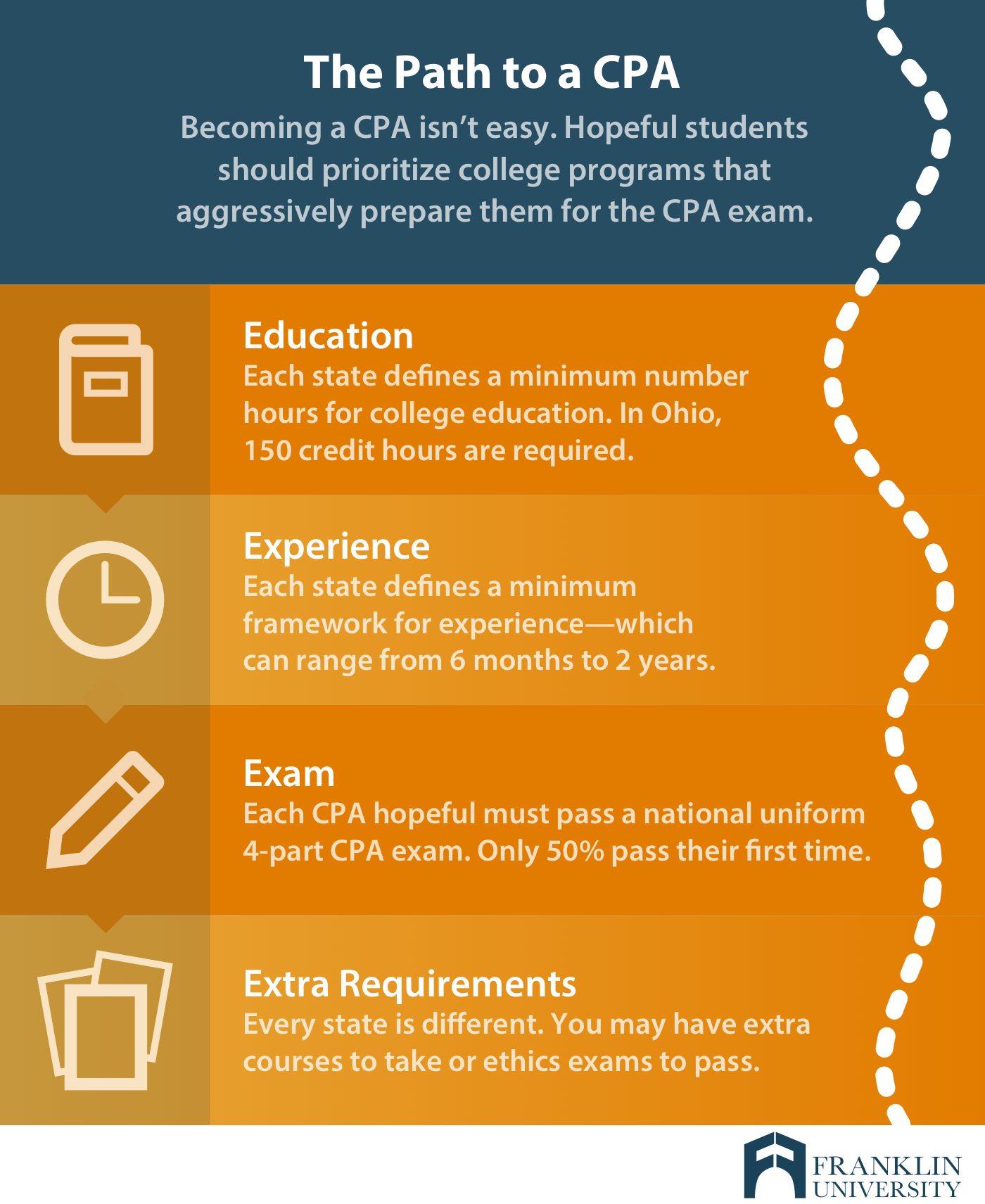

What are the Overall Requirements for Becoming a CPA?

It’s not easy to get your CPA license. It’s a long, demanding process because it ensures the highest standards of both fiscal and ethical practices. If you’re looking to increase your earning potential, become a senior-level professional or work at a large company, you should invest your time and energy into getting your CPA license.

Ready to make your move in accounting? Gain insights for every career stage in our free Accounting Career Guide.

CPA licenses are granted at the state level, so requirements to become a CPA vary by state. Overall, there are four main requirements to become a CPA.

These are the overall requirements, but again, these vary by state. We will go into the details of each of these requirements for the state of Ohio to give you an in-depth view of this process.

Step 1: Meet the Ohio CPA Minimum Education Requirements

To become a CPA in Ohio you must complete 150 semester hours of acceptable coursework. You must complete 30 semester hours in accounting, 24 semester hours of which must be above the introductory level. Courses within this concentration must include:

- Auditing, not including internal auditing

- Financial accounting

- Management and cost accounting

- Professional ethics for CPAs

- Taxation

You must also meet minimum education requirements in other business coursework. These include courses such as business law, economics, finance, management or marketing.

If you pass the Graduate Management Admission Test (GMAT) with a minimum score of 620 and hold an associate or bachelor’s degree that fulfills the minimum 30 hours of accounting coursework, you may not need to get all 150 credit hours, but would be required to get additional experience.

Step 2: Complete the Required Hours of Experience for the State of Ohio

Ohio CPA candidates must work in the field for at least one year. This experience can include working at a public accounting firm, for government, for business or in academia. Experience requirements are not uniform and may vary based on your education level. The easiest way to ensure the experience requirement is met is to carefully review board rules and contact the Accountancy Board of Ohio with any questions.

Step 3: Complete an Approved Course in Professional Standards and Responsibilities

The Accountancy Board of Ohio requires you to take a course in professional standards and responsibilities (PSR) that emphasizes Ohio law and accounting board rules. A list of approved sponsors for PSR courses can be accessed through the Accountancy Board of Ohio.

Step 4: Pass the Uniform CPA Examination

The Accountancy Board of Ohio uses NASBA to administer the application and testing process for the Uniform CPA Exam. You may apply to sit for the exam through the NASBA website. All four sections of the exam must be passed within an 18-month rolling period.

Each section of the CPA exam is a four-hour test and they can be taken in any order. The four sections of the CPA exam include:

- Auditing and Attestation (AUD). This section covers all auditing and assurance services performed in public accounting. It tests your knowledge of the AICPA professional code of conduct, audit process, reviews, compilations and attest engagements.

- Financial Accounting and Reporting (FAR). The FAR test covers the most information out of any exam section. It tackles the entire topics of financial accounting and reporting, including the FASB framework, financial statement preparation, U.S. GAAP rules and IFRS rules.

- Regulation (REG). REG is the only exam that doesn’t explicitly cover accounting topics. Instead, it focuses on business and individual taxation, business law and ethics.

- Business Environment and Concepts (BEC). This test is a comprehensive look at the environment that businesses operates in. It covers topics like macro- and micro- economics, cost accounting, management and information systems.

Each exam part is formatted into question blocks called testlets that contain either multiple-choice questions or task-based simulations.

To pass the exam you will need to intensely study the topics for each section to get the required score of 75 (graded on a scale of 0 to 99) in each of the four sections to pass. Anywhere between 100 and 180 hours of study is recommended for each section. Many examinees choose to complete an exam prep course in addition to individual study.

Step 5: Complete a Criminal Background Check

A criminal records check is required to obtain a CPA license in Ohio. The records check is fingerprint-based and fingerprints must be submitted electronically through an approved “WebCheck” vendor. The background check includes both Ohio and federal records.

Step 6: Apply for an Ohio CPA License

The final step to obtaining a CPA license in Ohio is completing the Application for Original Ohio Certificate of Certified Public Accountant. You must include the appropriate verification of experience forms with the application.

Once you have your CPA license, you must complete 120 continuing education hours every three years to renew your license. Continuing education subject areas are based on your area of professional practice. You can find additional information at the Accountancy Board of Ohio website.

Take the First Step to Getting Your CPA License

Getting your CPA license is no easy task, but with focus and dedication it can lead to a long and fruitful career in an industry that expects to grow 10% through 2026 (much faster than average). You will also far outearn non-certified accountants, both at the outset and throughout your career, with unlimited potential for advancement.

Get Your Bachelor’s Degree in Accounting

The ideal first step to getting your CPA is to get your B.S. in Accounting. Franklin University's B.S. in Accounting program is built to the professional standards required of CPAs. It will not only prepare you with the necessary coursework, but with industry-standard software and simulations similar to what you will encounter in the CPA exam. You can complete coursework 100% online or at one of our campuses.

Finish Your 150 Semester Hours with a Master’s Degree or Additional Bachelor's Degree

If you have already completed your B.S. in Accounting, and need to complete enough credits for the 150 total hours required, you can complete a master’s degree or an additional bachelor’s program in a related field.

The Franklin University M.S. in Accounting will prepare you with an executive skill set that prepares you to advance into an accounting leadership position. You can also choose from two pathways—taxation or financial operations—to tailor your degree to your career pursuits.

You could also complete the Franklin University B.S. in Forensic Accounting or B.S. in Business Forensics as a more cost-effective way to reach the 150 total hours required to sit for the CPA exam. If you are interested in a career in fraud prevention, these degrees are a great way to get specialized skills in this field.