I Have an Associate Degree in Accounting: Now What?

An associate degree in accounting is a strong first step into the accounting field. Getting your associate degree in accounting can help open doors to entry-level positions that help you determine if a career in accounting is right for you.

After gaining this foundational experience, you may wonder how far an associate degree can take you. Let’s look at which jobs you can pursue straight out of an associate program, and which roles will require additional education. Then you will find a roadmap that will help you pave the way for a successful long-term career in the accounting industry.

What Can You Do with an Associate Degree in Accounting?

An associate degree in accounting teaches the fundamental processes of accounting, such as tracking, monitoring and reporting financial information. These principles translate into the skills required for entry-level technical positions.

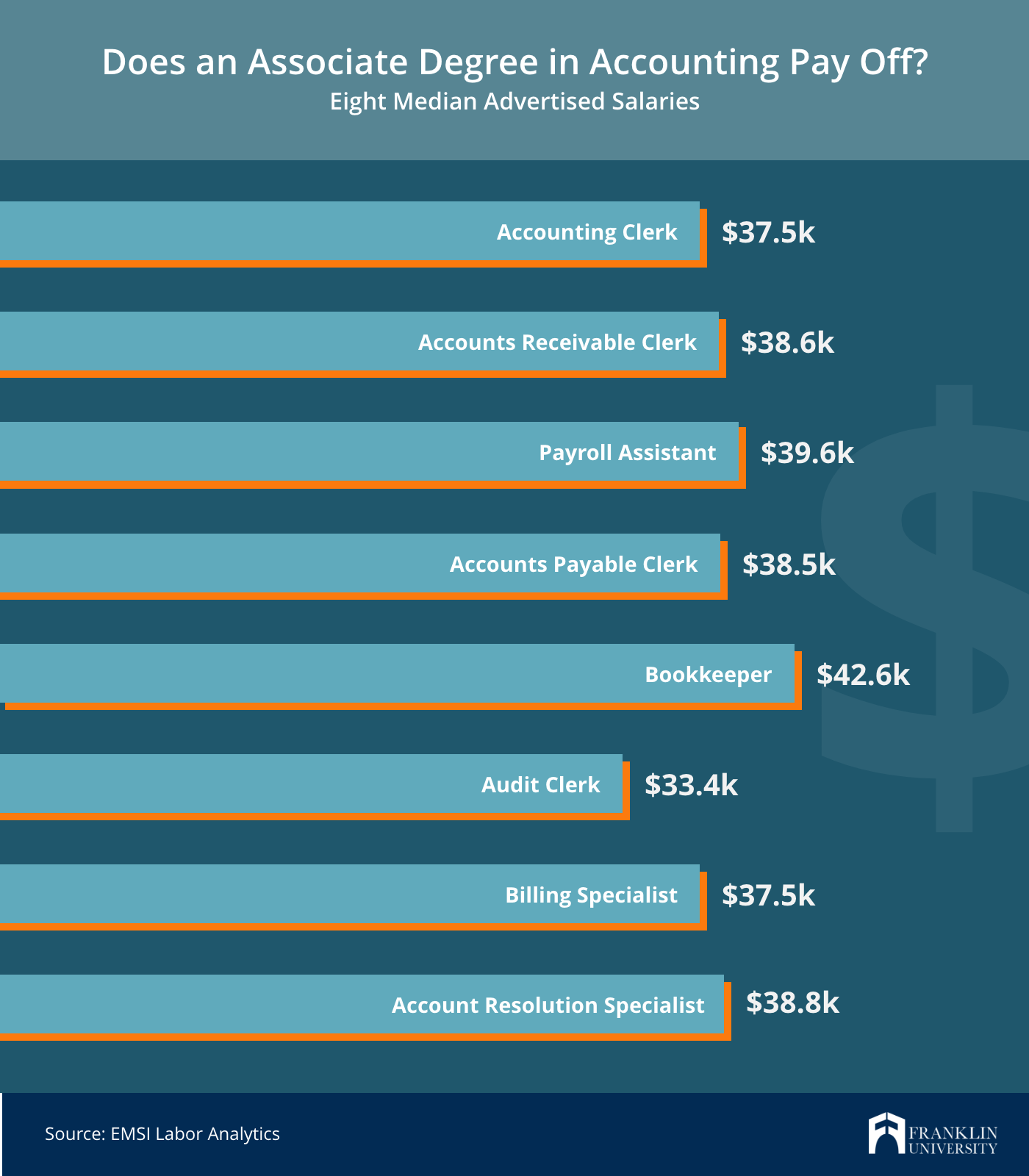

Let’s look at eight jobs for professionals with an associate degree in accounting, as well as the median advertised salaries for these positions according to leading labor analytics firm EMSI.

- Accounting Clerk | $37.5K: These professionals complete the necessary clerical work for accurate accounting practices. Accounting clerks perform general office tasks, such as organizing documents, filing reports, and updating organization or client financial records.

- Accounts Receivable Clerk | $38.6K: Accounts receivable clerks are responsible for ensuring a company receives payment for its goods and services. This job includes posting, verifying and recording customer payments, as well as tracking outstanding invoices.

- Payroll Assistant | $39.6K: Payroll assistants collect, calculate and enter timesheet data. They also resolve payroll discrepancies and ensure proper compensation for all employees.

- Accounts Payable Clerk | $38.5K: These professionals complete payments on behalf of companies. The primary responsibilities of accounts payable clerks are to receive, process, verify and reconcile invoices to control expenses.

- Bookkeeper | $42.6K: Bookkeepers typically work at smaller organizations and are responsible for a wide variety of accounting and financial tasks. Bookkeepers oversee a company's financial data and compliance by maintaining accurate accounts, payroll, financial entries, and reconciliations.

- Audit Clerk | $33.4K: Audit clerks assist with the planning and administration of audit assignments. Their responsibilities include supporting auditors by drafting financial statements, preparing budgets, and verifying financial information.

- Billing Specialist | $37.5K: Billing specialists typically work for insurance companies or healthcare organizations. They ensure accurate financial records and perform payment procedures. These professionals also create and check for calculation errors on invoices and other billing statements received by customers or patients.

- Account Resolution Specialist | $38.8K: These professionals are responsible for evaluating debt risk and resolving past-due accounts. Account resolution specialists contact delinquent customers, develop payment plans, and bring accounts up to date as payments are made.

If you want to move beyond administrative and clerical accounting roles, you will need to advance your education and skills.

Ready to make your move in accounting? Gain insights for every career stage in our free Accounting Career Guide.

What Careers Could I Pursue If I Level Up My Skills and Education?

If your goal is to become a full-fledged accountant, you’ll need to earn a bachelor’s degree. A bachelor’s degree is required for staff accountant roles. For senior, management and leadership roles, a bachelor’s degree is a must and a master’s degree may be beneficial to set yourself apart.

Here are four specialized accounting roles that require a bachelor’s degree:

- Tax Accountant | $75.1K: Tax accountants offer clients financial and tax advice. They help them follow tax laws and regulations, while developing strategies to minimize or defer tax payments.

- Financial Data Analyst | $77.1K: These professionals turn financial data into insights that drive strategic decisions. A bachelor’s degree is required to gain the advanced mathematical, research and financial analysis skills you need to make sound recommendations.

- Forensic Accountant | $87.8K: Forensic accountants compile financial evidence to aid in the prosecution of financial crimes. These professionals will work with law enforcement to build a case using financial data, and may be asked to testify in court.

- IT Audit Manager | $134.9K: These professionals manage a team to audit information systems, platforms and processes to ensure financial information is readily available, accurate and securely stored.

Four Steps to Advance Your Career After Earning an Associate Degree in Accounting

Ready to climb the ladder in the accounting field? Let’s map out the next steps you need to take after earning your associate degree in accounting.

Step 1: Earn Your Bachelor’s Degree in Accounting

Getting your bachelor’s degree is the natural next step for associate degree holders looking for advancement opportunities. Earning a bachelor’s degree in accounting substantially increases your salary expectations. According to EMSI, the median advertised salary for accountants and auditors with a bachelor’s degree is $73.6K.

Bachelor’s degree programs build on your baseline technical skills to prepare you to be a well-rounded professional who has the necessary hard and soft skills to succeed.

There are two common bachelor's degree pathways for aspiring accountants:

- B.S. in Accounting: This degree provides the full range of accounting skills employers desire in areas such as: financial reporting and analysis, managerial accounting and cost management, tax accounting, auditing, accounting ethics, and financial management. Individuals pursue a B.S. in Accounting if they want to gain a broad set of skills that will give them more career flexibility, or they want to prepare for the CPA exam.

- B.S. in Forensic Accounting: This degree combines foundational accounting principles with fraud detection and prevention techniques. Many courses overlap with a standard accounting program, while giving you the opportunity to specialize with courses in occupational fraud forensics. Individuals pursue a B.S. in Forensic Accounting if they are problem solvers who want to use their accounting skills to support the common good.

Pro Tip: Look for programs that accelerate your time to graduation by allowing you to transfer credit from your associate degree into a bachelor’s degree program. Transfer-friendly universities, such as Franklin University, allow you to transfer up to 76% of the credits required to graduate with a bachelor’s degree.

Step 2: Gain Experience in a Staff-Level Accounting Role

After completing a bachelor’s degree program, it’s important to gain hands-on experience working as an accountant. Choose from working in public accounting—for firms that work for clients across industries to provide accounting services—or as an industry accountant that works for a single organization on an internal accounting team. Either path you choose will provide valuable experience that can set the trajectory for the rest of your career.

Three benefits of gaining experience working in staff-level accounting roles:

- Get exposed to multiple job functions within finance departments to understand which roles might be best suited to your skillset and career aspirations.

- Inform whether you want to pursue a specialty, such as tax, audit or management accounting.

- Gain the skills and experience necessary to sit for various accounting certifications.

Step 3: Consider Getting Your Master’s Degree

A master’s degree in accounting teaches you to think critically about big-picture accounting systems and processes, communicate more effectively, and leverage technology in new and innovative ways.

In addition to showcasing your dedication and expertise, a master’s degree will also give you the chance to further specialize your skillset. Master’s degree programs may offer the opportunity to define a specific focus area, such as financial operations or taxation. For example, Franklin University offers two focus area options—taxation and financial operations.

Step 4: Gain Advanced Accounting Credentials

In the accounting field, moving to the management level and beyond may require advanced credentials. If you want to pursue a career in public accounting, a CPA license will be essential. Let’s examine two pathways for accelerating your career growth.

Earn your CPA license: A CPA license is the most popular accounting certification among accountants and employers. A master’s degree can also help you achieve the minimum credit requirement to sit for the CPA exam. Before you take the CPA exam, you must earn at least 150 credit hours, which is 30 more than the typical 120 required for a bachelor’s degree.

Earn other well-respected accounting credentials: Certifications can help you showcase your specialized skills in areas such as auditing, forensic accounting, management accounting and more. Seven of the most prominent include:

- Certified Financial Analyst (CFA): Verifies knowledge of portfolio management, economics, professional and ethical standards, and investment analysis.

- Certified Fraud Examiner (CFE): Demonstrates expertise in four areas of fraud examination, including financial transactions and fraud schemes, law and fraud prevention, and investigation.

- Certified Internal Auditor (CIA): The only internationally accepted distinction for those seeking an internal auditor career, the CIA signifies competencies in risk and control as well as information technology.

- Certified Management Accountant (CMA): Verifies competency in cost management, decision analysis, forecasting, and internal control auditing.

- Chartered Global Management Accountant (CGMA): A global certification for CPAs who work in business and government, the CGMA validates expertise in developing business strategies that connect all areas of business.

- Enrolled Agent (EA): Professionals with an EA are licensed by the IRS to advise clients, prepare personal and business taxes, and work with the IRS on a client’s behalf.

- Financial Services Audit Certificate (FSAC): Ideal for accountants who are interested in audit, fraud and risk management careers. It showcases expertise in 11 areas, including cybersecurity risks, fraud risk assessment, credit risk and more.

Take the Next Step in Your Accounting Career

Many professionals pursue their associate degree because they want to fast-track entering the workforce or kick start their career in a new industry. Once it’s time to advance, it’s important for working professionals to find a degree program that will support their education goals without requiring them to press pause on their career.

Franklin University is dedicated to meeting the needs of working adults looking to advance their education. Franklin offers a 100% online bachelor’s degree in accounting that allows associate degree graduates to transfer up to 3 years worth of credits into a bachelor’s degree program. Franklin employs real-world practitioners with deep industry experience to teach classes that adhere to accounting best practices and use the most prominent industry technologies.

Learn more about Franklin’s B.S. in Accounting and how it will help you take your career to the next level.