Request Information

We're Sorry

There was an unexpected error with the form (your web browser was unable to retrieve some required data from our servers). This kind of error may occur if you have temporarily lost your internet connection. If you're able to verify that your internet connection is stable and the error persists, the Franklin University Help Desk is available to assist you at helpdesk@franklin.edu, 614.947.6682 (local), or 1.866.435.7006 (toll free).

Just a moment while we process your submission.

Public vs. Private Accounting: Which is the Better Career Path For You?

Accounting is a dynamic industry full of career opportunities. According to leading labor market analytics firm EMSI, jobs for accountants and auditors are expected to grow 5% by 2031.

Many of these job opportunities fall within two career paths—public accounting and private accounting. While public and private accounting are two distinct paths, it’s common for accountants to switch between them during the course of their careers. That’s why it’s important to understand both paths at the outset, so you can identify which path is best suited for you now and in the future.

Let’s dive into what defines public vs. private accounting and the pros and cons of choosing to work in either sector.

What is Public Accounting?

Public accounting refers to a business or individual accountant who provides services for multiple clients, which can be individuals or large corporations. Whether public accountants work in private practice or for an international accounting firm, they are responsible for understanding every client’s unique needs and helping them make the best financial decisions.

Public Accounting Education and Credentials

To join the ranks of public accountants, the minimum education is a bachelor’s degree in accounting. While a bachelor’s degree will get you in the door, becoming a Certified Public Accountant (CPA) is essential to advancing in this sector. Accountants earn their CPA license from a state board, which sets standards for education and experience. Accountants must also pass the rigorous CPA exam before earning their license.

Public Accountant Responsibilities and Skills

The role of public accountants varies based on the size of their employer and client needs. The core functions of public accountants typically include a combination of:

- Preparing financial statements

- Tax advising, preparation and filing, as well as providing audit representation

- Performing audit and assurance services

- Consulting on financial performance and management

In addition to technical accounting skills, public accountants also need strong personal skills. Since they are client-facing, public accountants need to be able to:

- Communicate clearly: Public accountants need to be able to translate complex, technical accounting information into terms that an individual or client can easily understand and act upon.

- Manage stakeholders: Working with large organizations can get complicated, as many important voices come to the table to discuss a company’s financial health. Public accountants need to be able to actively listen, while properly prioritizing input.

- Stay composed: In the midst of managing multiple clients and deadlines, public accountants need to stay cool and collected under pressure. Maintaining strong organizational and time management skills is key to succeeding in this demanding environment.

- Maintain high ethical standards: Public accountants deal with sensitive personal, company and financial information. As part of becoming a CPA, accountants must adhere to strict professional standards and act as a fiduciary for their clients, which means putting their clients’ interests first.

Public Accounting Careers and Salary Expectations

According to the American Institute of Certified Public Accountants (AICPA), there are currently over 46,000 public accounting firms in the United States ranging in size from small local accounting practices to large international CPA firms. Four of the largest employers within this space are Deloitte, Ernst & Young, KPMG and PwC—collectively known as “The Big Four.” Public accounting jobs at these international accounting firms are highly coveted and competitive.

According to EMSI, the median advertised salary for CPAs is $90,000 across all accounting functions. Median salaries for CPAs are highly influenced by years of experience in the industry. Salaries may also be impacted by the specialization a public accountant chooses.

Let’s look at three of the most common career paths within public accounting, as well as the median advertised salaries across all experience levels (EMSI):

- Accounting and auditing services | $77.7K: These roles focus on maintaining accurate financial records, as well as producing and auditing financial statements that will be used by outside parties such as investors or banks.

- Tax services | $73.1K: A specialization in tax involves the preparation of tax returns, as well as advising clients on deductions, tax planning and other tax-related issues. These CPAs will also defend clients in the event of an audit from the IRS.

- Management consulting services | $83.2K: These accounting professionals are involved in a wide range of financial planning for individuals and businesses. They may help an individual create a long-term financial plan or help a business’s management team improve their bottom line.

If public accounting seems intriguing, it’s only one side of the accounting industry. There are also a multitude of career opportunities in the other major sector—private accounting.

What is Private Accounting?

Private accounting, also commonly called industry or corporate accounting, refers to accountants who work for a single organization within its internal finance department. Private accountants work across every industry and sector, making this a stable career choice no matter where you live and work.

Private Accounting Education and Credentials

If you want to work in the private accounting sector, you will need a bachelor’s degree in accounting. Unlike public accounting, you do not need a CPA license in order to advance. Other credentials, such as a master’s degree in accounting or an MBA can be beneficial in helping you rise through the ranks. A master’s degree in accounting is ideal for professionals who want to specialize in accounting and finance, while an MBA can help accountants gain cross-functional leadership skills.

Private Accounting Responsibilities and Skills

The role of private accountants will vary based on their employer, industry and size of their finance department. The core functions of private accountants typically include a combination of:

- Implementing accurate and efficient accounting processes, and ensuring they are maintained.

- Planning department and company budgets, as well as evaluating spending against budgets.

- Evaluating the fiscal performance of an organization, as well as forecasting future performance.

- Creating financial reports and helping derive insights for upper management.

To succeed within this role, private accountants need a strong combination of technical skills and interpersonal characteristics, including:

- Data analysis and forecasting: Private accountants need to be able to use the latest technology to turn information into insights. Data manipulation, visualization and forecasting skills are all necessary to make an impact in an organization.

- Clear and concise communication: The amount of information that accountants take in and put out can be overwhelming to many other functions within an organization. Accountants need to be able to distill data and produce clear and actionable insights for business leaders.

- Detail oriented: Accuracy is at the heart of the accounting function. Being detail oriented also extends beyond individual calculations. Private accountants need to be meticulous in managing their time and adhering to deadlines as well.

- Self-motivated: It’s important for accountants to feel confident acting with autonomy, especially within smaller organizations. The more an accountant is willing to learn and undertake, the easier it will be to advance.

Ready to make your move in accounting? Gain insights for every career stage in our free Accounting Career Guide.

Private Accounting Careers and Salary Expectations

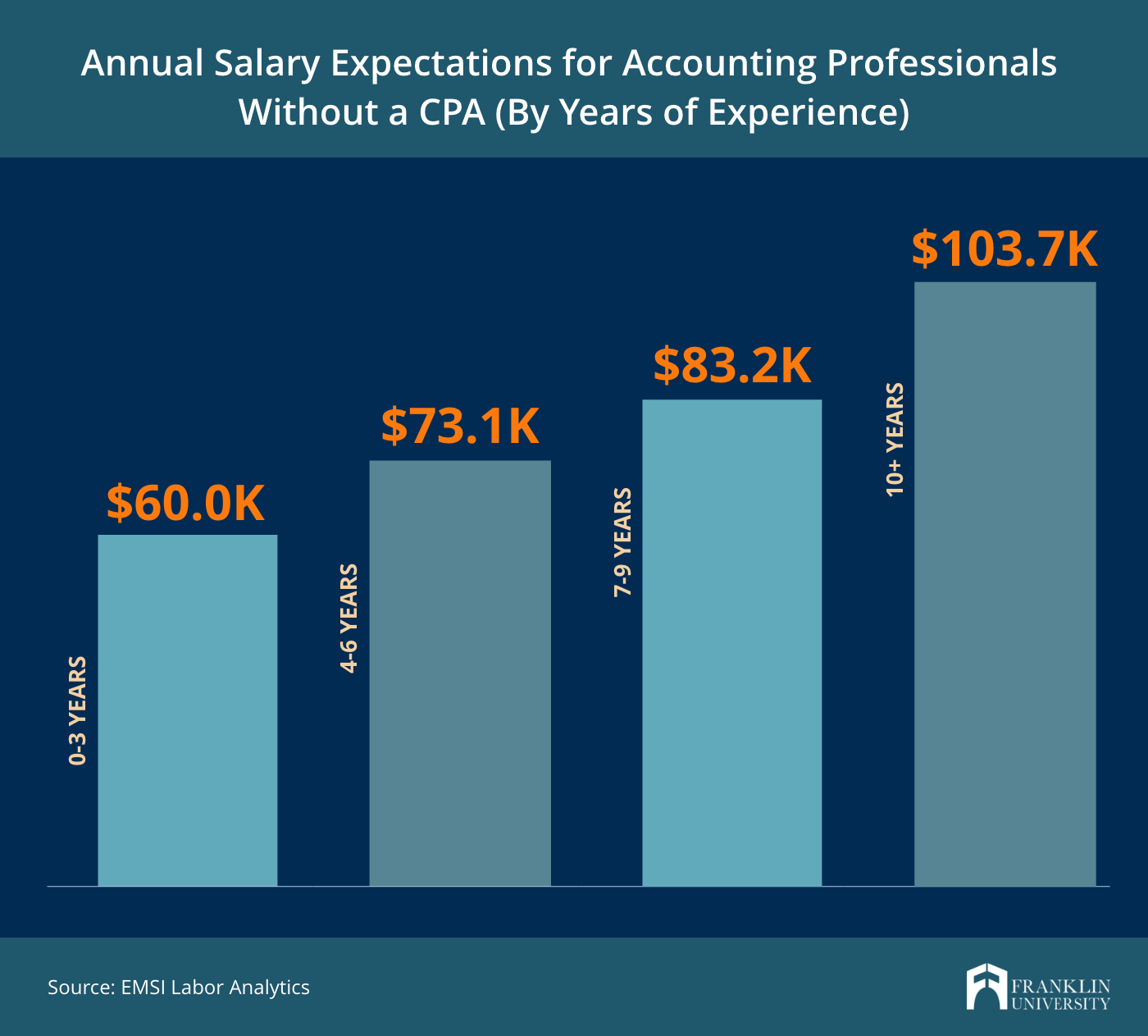

If you’re looking for a career path that doesn’t require earning a CPA license, private accounting is the right path for you. According to EMSI, in 2021 there were 170,481 job postings for accountants and auditors with a bachelor’s degree and no CPA license. Expected salaries for accountants without a CPA are heavily influenced by years of experience.

Let’s look at four popular career options within private accounting that don’t require a CPA, as well as the median advertised salaries across all experience levels (EMSI):

- Staff Accountant | $60.4K: This entry or mid-level position is responsible for maintaining financial records for a business. Their day-to-day duties typically include ensuring IRS compliance, reconciling bank statements, and balancing the ledger for regular reports.

- Auditor | $67.5K: Auditors working within an organization review accounting processes to improve efficiency, accuracy and adherence to internal and external reporting standards.

- IT Auditor | $77.6K: IT auditors focus specifically on improving processes from a technology standpoint—from databases to software programs and information management systems. The goal of these professionals is also to ensure information is being stored properly and securely.

- Financial Analyst | $83.2K: These professionals are responsible for financial planning, analysis and forecasting for their company. They project future revenues and expenditures, which helps a business establish costs and budgets for its strategic initiatives.

Now that you understand the fundamentals of these two accounting career paths, let’s evaluate the pros and cons of working in public vs. private accounting.

Pros & Cons of Working in Public Accounting

Public accounting firms are known for being demanding workplaces. Depending on your personal and professional priorities, working in public accounting may come with both positives and negatives.

Three pros of working in public accounting:

- Diverse experiences: Public accounting exposes accountants to different industries, clients and internal teams. This broad exposure not only helps public accountants grow their technical skills, but also improves their interpersonal skills.

- Ample advancement opportunities: Public accountants typically spend one to two years in a staff-level role. After earning a CPA license, public accountants can rise through the ranks quickly due to the intensive time and work they put in.

- Chance to specialize: Due to the number of clients a public accounting firm serves, accountants with specialized expertise in areas such as tax, audit or management consulting are necessary.

Two cons of working in public accounting:

- High-stress environment: Public accountants will always be working with multiple clients—balancing different projects, deadlines and personalities. Public accounting is often described as fast-paced and demanding, which some accountants may find difficult.

- Inconsistent work schedule: Public accountants should expect long hours, last-minute pivots, and client travel to be the norm. This can make work/life balance difficult to achieve.

Pros & Cons of Working in Private Accounting

Private accounting provides a solid and steady long-term career path. Some accountants will appreciate this atmosphere, while others may look for faster-paced environments. These are some of the pros and cons to consider if you want to pursue private accounting.

Three pros of working in private accounting:

- Strong work/life balance: Private accountants can expect to work standard office hours, with limited to no travel. This schedule makes it easy for accountants with family or personal commitments to balance their professional goals with their other responsibilities.

- Less stressful environment: As a private accountant, all focus is placed on a single business and its finances. Private accountants don’t have to worry about balancing multiple clients or competing deadlines, which results in a lower stress workplace.

- Advancement is possible without a CPA license: Unlike public accounting where a CPA license is essential for promotion to management positions, CPAs are less emphasized in private accounting. A CPA may be a benefit, but it's much less likely to be mandatory.

Two cons of working in private accounting:

- Advancement may take longer to achieve: Private accountants will find it more difficult to advance due to the limited size and scope of a company’s internal finance department. There are often a finite number of roles, especially among upper management.

- Lack of diversity in day-to-day work: Some accountants may find the world of private accounting to be monotonous. Tasks and responsibilities are routine-driven and typically follow a consistent cadence.

Is Public or Private Accounting Better?

The choice between public and private accounting is very personal. Some accountants may thrive in the demanding, fast-paced environment of a public accounting firm. Others may prefer the steady, low-stress environment of a private accounting job.

There is also no reason you have to choose the public or private path for the entirety of your career. It’s very common for accountants to pursue a job in public accounting at the outset, then transition into private accounting. This scenario can also be advantageous in terms of accelerating advancement. Often, public accountants will be promoted more quickly, which allows a public accountant to enter the private accounting field at a higher level than their private peers.

Whichever path you choose, it’s important to build a strong foundation of accounting knowledge and skills to succeed in public or private accounting.

Start Your Accounting Career With a Bachelor’s Degree in Accounting

Getting your bachelor’s degree in accounting is more accessible than ever before. Franklin University offers a 100% online B.S. in Accounting that will help you gain the industry-ready skills to work in the public or private accounting environment. In addition to building your accounting capabilities, Franklin gives you a jump-start on pursuing a professional certification, saving you both time and money.

Learn more about Franklin’s bachelor’s degree in accounting program and how it can help you achieve your career goals.