Request Information

We're Sorry

There was an unexpected error with the form (your web browser was unable to retrieve some required data from our servers). This kind of error may occur if you have temporarily lost your internet connection. If you're able to verify that your internet connection is stable and the error persists, the Franklin University Help Desk is available to assist you at helpdesk@franklin.edu, 614.947.6682 (local), or 1.866.435.7006 (toll free).

Just a moment while we process your submission.

How to Pay for College Without Loans

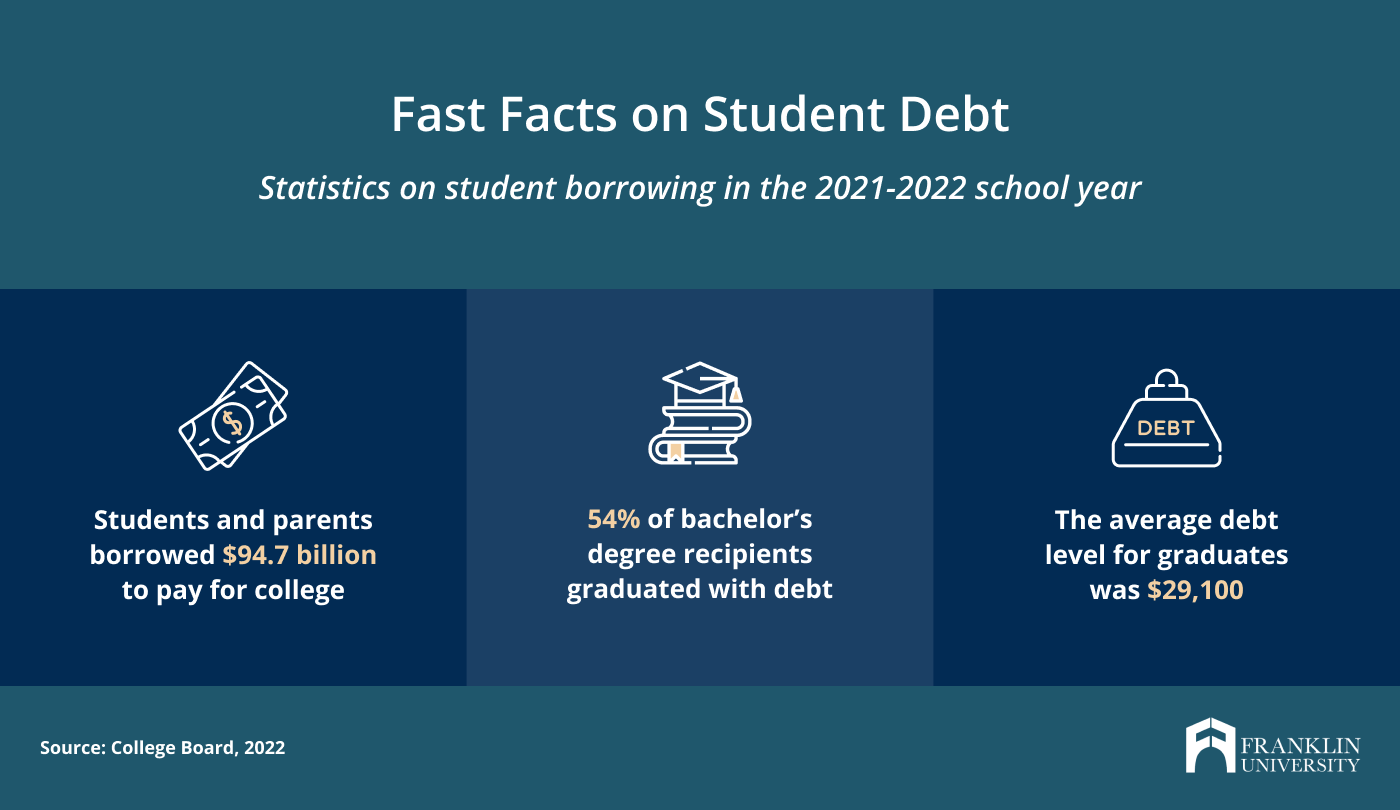

College is expensive, and one of the most common ways to pay for a degree is by taking out student loans. In the 2021-2022 school year, U.S. students and parents took on a total of $94.7 billion in education debt.

However, if you wish to avoid taking on debt – or simply want to keep it to a minimum – it’s still possible to earn a college degree, even if you aren’t sitting on a pile of savings.

To help you graduate without signing up for years of loan repayment, Franklin University’s financial aid experts have rounded up the information you need about student debt and their top tips to avoid it.

What Are Student Loans?

Student loans are specifically designed to cover the costs of a degree program, including tuition and fees, living expenses and costs like books and supplies.

They come in two basic categories: federal and private student loans. Federal loans tend to offer more benefits and options for repayment. They may also offer subsidies or lower interest rates than private loans. However, the federal government limits the total amount of federal loans you can take out. Within those limits, your school will determine the amount you are eligible for.

The federal loans available to undergraduate students are:

1. Federal Direct Subsidized Loans

These loans are available to undergraduate students based on financial need (as determined by the school). The federal government pays the interest charges while you’re in school, for six months after you graduate, and while the loan is deferred (for example, if you enroll in graduate school). These loans do not require a credit check.

2. Federal Direct Unsubsidized Loans

Unlike subsidized loans, Federal Direct Unsubsidized Loans are available to all undergraduate students, regardless of financial need. Your school determines how much you can borrow (up to federal limits) based on your estimated cost of attendance and the other financial aid you are receiving. While you don’t have to make payments on these loans while you’re enrolled in school, interest will continue to accrue. They do not require a credit check.

3. Direct PLUS Loans

The federal government also offers two types of Direct PLUS loans – one which graduate students can take out themselves, and one that parents or guardians may take out to help pay for their child’s undergraduate education. The latter are also known as Parent PLUS Loans. The maximum amount that parents can take out is the cost of attendance (as determined by the school) minus other financial aid. Unlike federal Direct loans to students, parents’ credit ratings are taken into account for these loans. However, those with adverse credit history may still be eligible if additional requirements are met.

Private loans are all credit-based, meaning that your credit score and history (or your parent’s or spouse’s if you have a co-signer) are used to determine your eligibility and interest rates. Different lenders set their own policies and rates and can differ significantly in their repayment options, so it’s wise to shop around.

In the 2021-2022 school year, 54% of graduating bachelor’s degree recipients left college with debt, according to the College Board. Among those students who took out loans, the average debt level across both federal and private loans was $29,100. Even though student loans are common, it’s wise to take on as little debt as possible and avoid it entirely if you can.

When it comes to paying for school, grants are among your best options. But do you know how to find them? Remove the guesswork by downloading this free guide

How to Avoid Student Loans

If you use the right strategies, you may be able to avoid student loans entirely. And even if you are open to taking on some debt, these tactics can help you keep it to a minimum.

1. Apply for Financial Aid

While many financial aid packages include loans, you do not need to accept them. Even if you know you won’t take on loans, you should still apply for financial aid by filing the Free Application for Federal Student Aid (FAFSA) when you apply for school since it can help you access other forms of funding.

Depending on your financial situation, you may qualify for federal, state or institutional grants (or more than one type). Grants are monetary awards that you do not repay. You may also qualify for federal work-study, which will help you to earn money toward your degree.

2. Look Into Employer Assistance

In addition to grants and federal work-study, you may also be able to find other sources of external funding for your education. If you’re currently working, check to see if your employer offers any form of tuition assistance or reimbursement. Many companies and organizations offer these programs, and it’s always worth asking, especially if the degree you are pursuing is related to your work.

3. Apply for Scholarships

Many students assume scholarships are only for student-athletes, but that’s a big misconception. In fact, there are plenty of scholarships available for all different kinds of students.

- Some schools, including Franklin University, offer scholarships to some students based on their merit. Qualifying criteria may include high school GPA and a personal essay.

- Depending on your degree plans, you may be eligible for scholarships for specific programs, like nursing or STEM degrees. These may be offered by your school or by outside groups.

- Many scholarships are designed specifically for students who belong to minority groups or who have distinct life experiences. For example, you might apply for scholarships for Black students, Native American students, LGBTQ+ students, single parents or students who grew up in a certain state or city.

Generally, scholarship applications take place outside the FAFSA process, and they often require application materials like personal statements or essays. Franklin offers a streamlined scholarship application to help you apply for as many funding opportunities as possible without additional work.

4. Tap Into Military Benefits

If you served in the military, or if your spouse or parent did, you may be eligible for significant funding from the federal government through the Post-9/11 GI Bill. In addition to the cost of your degree, the program typically offers significant support for living expenses for you and your family.

There are also a number of scholarships available for active-duty service members, veterans and their families. These may be offered by schools or by outside organizations and nonprofits.

If you’re potentially eligible, be sure to look for colleges and universities that offer special programs and support for the military community. Franklin University, for example, offers a 20% tuition discount for active-duty military spouses and dependents and has several other scholarship and funding programs for military families.

5. Transfer Your Existing Credits

If you’ve started college before but didn’t make it all the way to graduation, you may be able to transfer your credits. Some schools, like Franklin University, also award prior learning credit that you can use toward your degree for work and life experience like professional certificates, certifications, licenses and military training.

Check transfer credit policies carefully when you’re applying to schools. The more credit you can bring in, the less you’ll have to pay – and the faster you’ll earn your degree.

You may also wish to consider starting your degree at a community college. Before you do so, though, check into the transfer policies of the four-year schools that interest you. Franklin, for example, welcomes students who transfer from community colleges, but not all schools will accept those credits.

6. Work While You Earn Your Degree

Students don’t just take out loans to pay for tuition and fees – they often use them to pay for living expenses like housing, food and transportation. If you continue working while you study, you may be able to pay for those expenses out of pocket or at least reduce your reliance on loans.

That said, balancing work and school can be difficult. It’s important to choose a program that supports adult and professional learners. Franklin University, for example, offers primarily online courses with flexible schedules designed to fit around other commitments. That means students don’t need to leave their jobs to study.

7. Budget Carefully

Budgeting isn’t the most exciting thing to do, but Lea Mederer, director of financial aid processing at Franklin, says it’s essential for students who wish to avoid loans. And budgeting monthly isn’t enough.

“Determine a budget that works for you, not just for the semester, but the entire academic year and through your time at the university until graduation,” she advised.

Don’t cut all of the fun out of your life, but remember that avoiding unnecessary spending while you’re studying can save you many thousands in interest in the long term.

Find a Degree That Won’t Put You in Debt

Franklin’s competitive tuition, flexible schedule and online options can help you minimize the cost of your degree. Since our programs are offered fully online, you won’t be paying unnecessary costs like parking or on-campus room and board.

Plus, Franklin’s locked-in tuition means you won’t be subject to any cost increases, and generous transfer policies can help save you time and money.

Best of all, Franklin’s programs are designed to prepare you for professional success, meaning that you won’t just graduate without debt but be ready to launch your career.

Learn more about tuition and financial aid at Franklin.