Accounting Careers: 10 of the Best Jobs in Accounting

Accounting is an essential function across every industry and business. It’s no wonder that demand for accountants and auditors is only anticipated to grow. According to the Bureau of Labor Statistics (BLS), jobs for accountants and auditors are predicted to grow by 7% by 2030. About 135,000 openings for accountants and auditors are projected each year, on average.

The essential nature of accounting roles, combined with strong growth prospects, makes accounting an attractive long-term career path. However, many prospective accountants don’t understand the full scope of opportunities at their fingertips.

This guide will give you insight into three popular career paths within the accounting field, as well as 10 entry-level to mid-level jobs within these sectors that can help you break into and advance in the accounting industry.

Three Popular Accounting Career Paths

Whether you’re considering your first job in accounting or finance, or want to change jobs in search of a more rewarding career, there are a multitude of opportunities for accounting graduates.

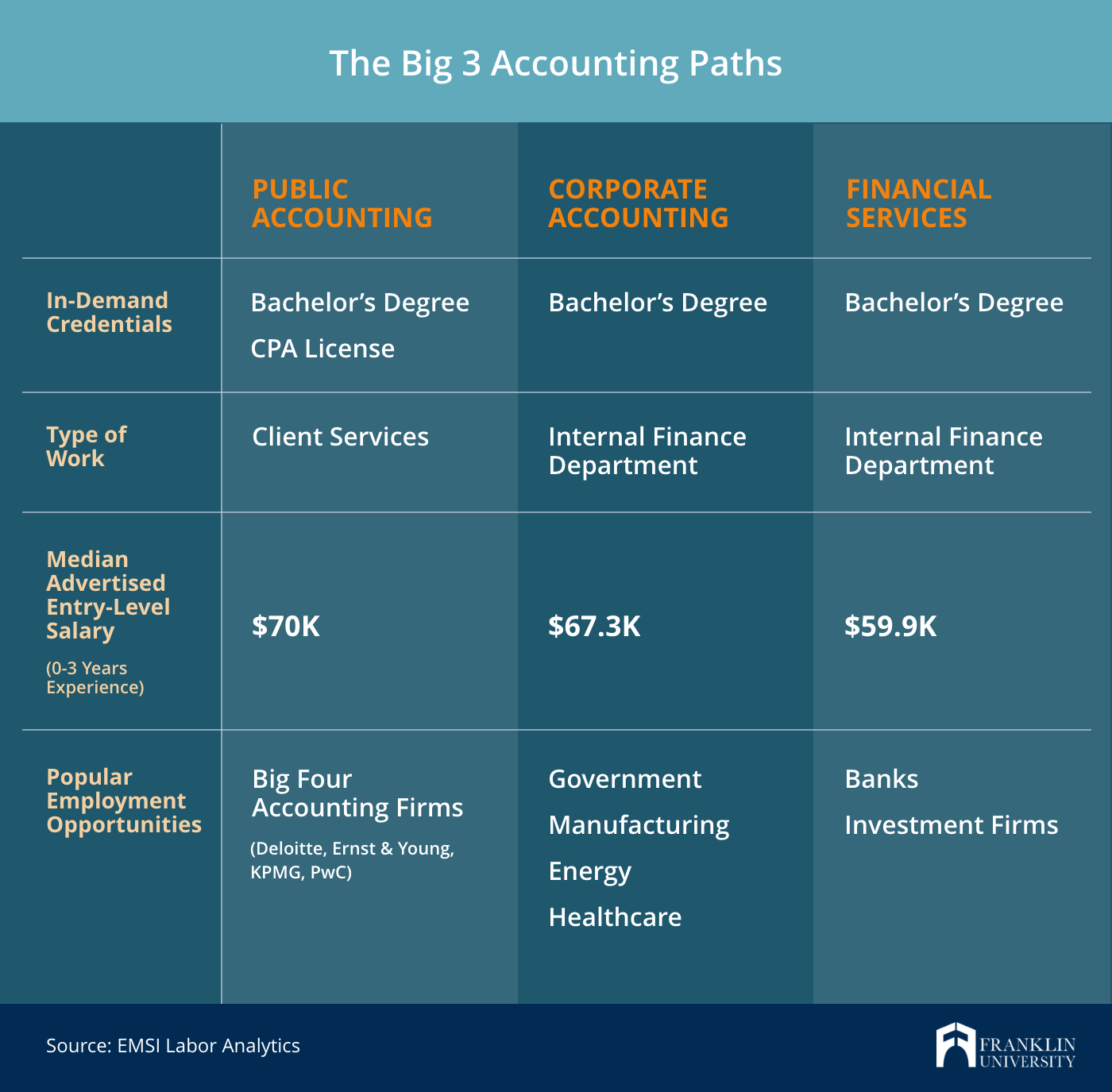

Many accounting careers fall within three sectors:

- Public Accounting: Public accounting refers to an accountant or business that helps a range of clients produce financial documents, prepare tax returns, or perform audit services. The “Big Four” public accounting firms—Deloitte, Ernst & Young, KPMG and PwC—are the top employers within this sector, accounting for over a quarter of a million jobs in 2020 (Statista). There are also extensive opportunities in private practice or local and regional firms. While careers in this sector are demanding, they offer the chance to gain diverse experiences and accelerate career growth.

- Corporate Accounting: Corporate accounting, also commonly referred to as private or industry accounting, refers to accountants who work for a single organization within its finance department. Corporate accounting varies widely by industry, but you can expect a more consistent schedule and less stressful environment than public accounting.

- Financial Services: The financial services sector is a broad range of more specific activities such as banking, investing and insurance. Together, these companies make up one of the economy's most important and influential sectors and offer extensive opportunities for accounting professionals.

Let’s dive into specific roles within these sectors, as well as their responsibilities and salary expectations for entry-level and mid-level roles. Salary data provided in this guide is based on the 2021 Financial Salary Guide published by Robert Half International, the world's first and largest accounting and finance staffing firm.

Ready to make your move in accounting? Gain insights for every career stage in our free Accounting Career Guide.

Two Careers in the Public Accounting Sector

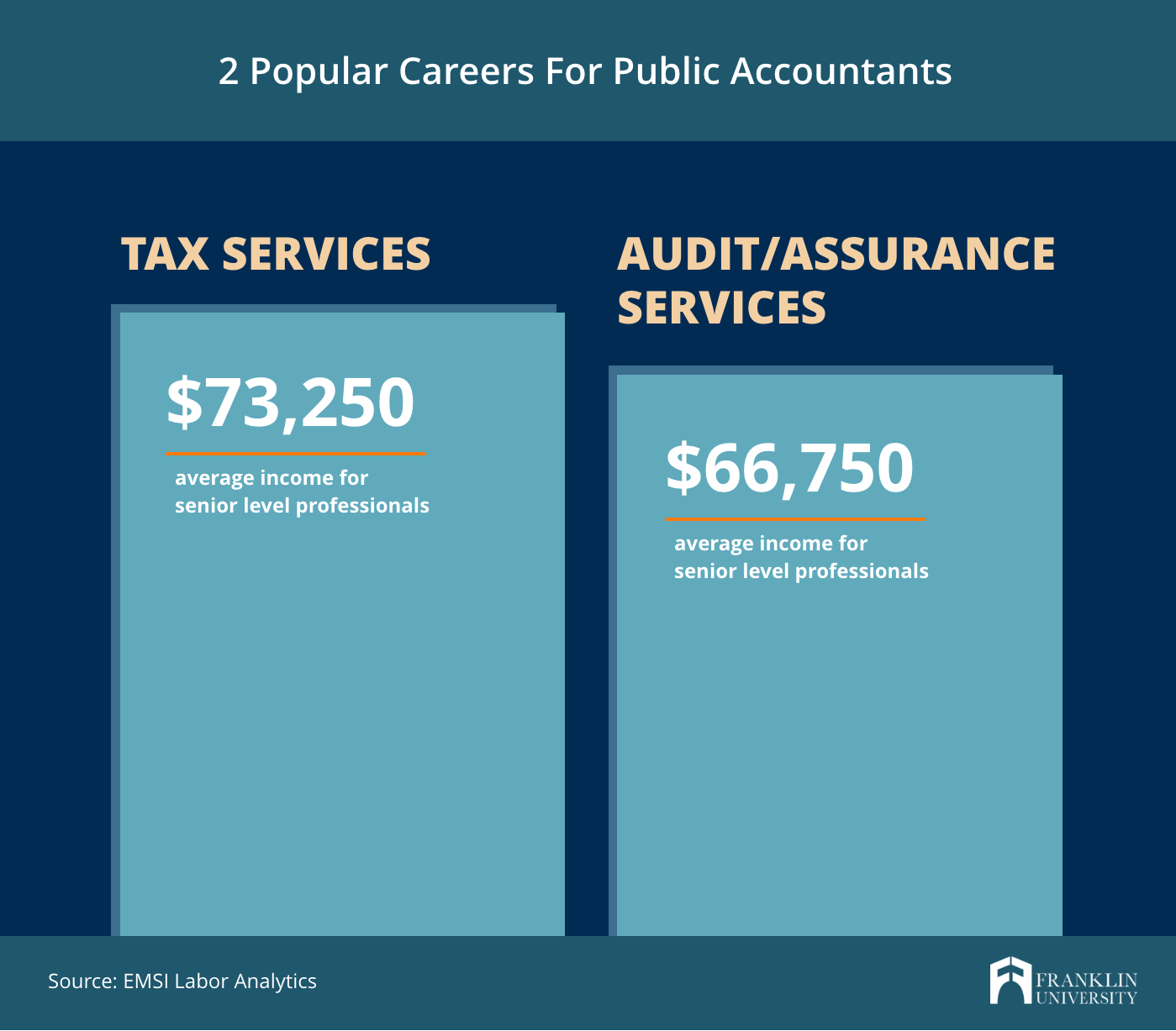

Public accounting firms offer a range of services to their clients. Two of the most prominent are tax services and audit and assurance services. Let’s explore the difference between these two career paths within public accounting and who is the best fit for these roles.

Tax Services

Public accountants that work within tax services provide clients with financial and tax advice to help them meet financial goals. The success of a tax accountant is measured by the financial stability and security of their clients. Becoming a Certified Public Accountant (CPA) is essential to advancement because it allows an accountant to create audited financial statements and represent a client in front of the IRS if a tax audit occurs.

Day-to-day responsibilities include:

- Monitoring clients financial needs and performance.

- Creating budgets and plans for staying on budget.

- Developing strategies to eliminate, minimize or defer tax payments using proper regulations.

- Preparing clients for audit.

Necessary characteristics:

- Strong communication skills

- Organized and deadline-driven

- Creative and solutions-minded

| Job Level | Median Salary |

| Entry-Level (up to 1 year) | $49,000 |

| Entry-Level (1-3 years) | $59,750 |

| Senior-Level | $73,250 |

Audit/Assurance Services

Auditors who work for public accounting firms are responsible for tracking the cash flow and accounts of their clients to ensure that they are being recorded and processed correctly. They also help protect assets through appropriate control measures and certify that financial records meet legal standards. A CPA license or Certified Internal Auditor (CIA) certification can help you advance your career in this specialization.

Day-to-day responsibilities include:

- Examining financial records and statements for accuracy.

- Inspecting budgets and the general ledger to ensure funds are available and expenditures are properly assigned.

- Preparing financial statements and records for federal, state, and internal auditors and similar authorities.

Necessary characteristics:

- Detail oriented

- Works well under pressure

- Strong problem solver

| Job Level | Median Salary |

| Entry-Level (up to 1 year) | $49,000 |

| Entry-Level (1-3 years) | $54,500 |

| Senior-Level | $66,750 |

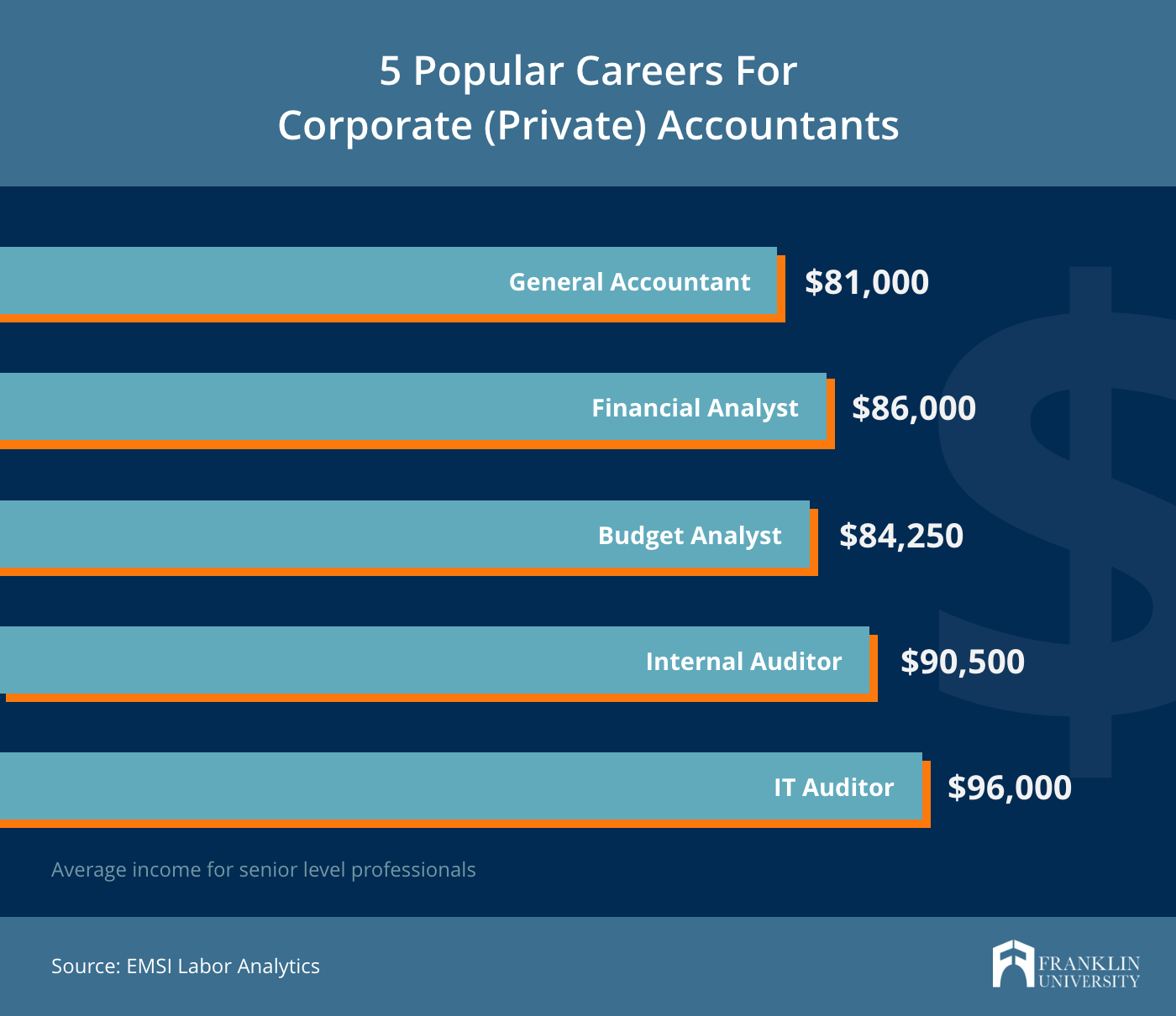

Five Careers in the Corporate Accounting Sector

Corporate accounting roles are found in nearly all sectors of the economy. These fundamental roles help businesses track their finances, ensure proper tax reporting and give a business a competitive edge. Let’s look at five career paths in corporate accounting and how the responsibilities differ.

General Accountant

A general accountant is a versatile professional with a broad base of skills and responsibilities. The primary role of a general accountant is to provide financial information based on research and analysis of accounting data. This analysis manifests itself through financial statements, annual reports and strategic recommendations.

Day-to-day responsibilities include:

- Documenting financial transactions and reconciling discrepancies.

- Maintaining accounting controls and financial security.

- Making recommendations to improve accounting operations and procedures.

- Preparing financial reports and recommending financial actions.

Necessary characteristics:

- Ability to work well in a team

- Analytical mindset

- Strong sense of accountability

| Job Level | Median Salary |

| Entry-Level (up to 1 year) | $48,750 |

| Entry-Level (1-3 years) | $64,500 |

| Senior-Level | $81,000 |

Financial Analyst

Financial analysts provide financial planning, analysis and forecasting for their organizations. One of their most important roles is forecasting future revenues and expenditures to budget for projects, stay competitive in the marketplace and improve profitability.

Day-to-day responsibilities include:

- Examining current and past financial data.

- Preparing reports and projecting future financial performance.

- Creating and assessing expansion plans.

- Exploring investment opportunities.

Necessary characteristics:

- Strong decision-making skills, especially under pressure

- Analytical problem-solving skills

- Confident self-management

| Job Level | Median Salary |

| Entry-Level (up to 1 year) | $53,500 |

| Entry-Level (1-3 years) | $69,500 |

| Senior-Level | $86,000 |

Internal Auditor

The job of an internal auditor is to bring an independent and objective point of view to improving an organization’s operations. These professionals help organizations meet their goals by creating a systematic, disciplined approach to evaluating the effectiveness of risk management, control and compliance processes.

Day-to-day responsibilities include:

- Identifying shortfalls or gaps in processes to reduce risk.

- Ensuring organizations comply with regulatory requirements.

- Investigating fraud or malfeasance.

Necessary characteristics:

- Strong moral compass

- Observant and detail oriented

- Analytical and decisive

| Job Level | Median Salary |

| Entry-Level (up to 1 year) | $48,250 |

| Entry-Level (1-3 years) | $73,750 |

| Senior-Level | $90,500 |

IT Auditor

An IT auditor evaluates and analyzes a company’s technological infrastructure. They ensure that processes and systems run accurately and efficiently, while also maintaining data security and meeting compliance standards.

Day-to-day responsibilities include:

- Developing efficient and detailed audit procedures.

- Testing and identifying network and system vulnerabilities.

- Providing recommendations based on identified security risks.

Necessary characteristics:

- Strong technical acumen

- Ability to learn quickly

- Process-orientedmindset

| Job Level | Median Salary |

| Entry-Level (up to 1 year) | $48,250 |

| Entry-Level (1-3 years) | $73,750 |

| Senior-Level | $90,500 |

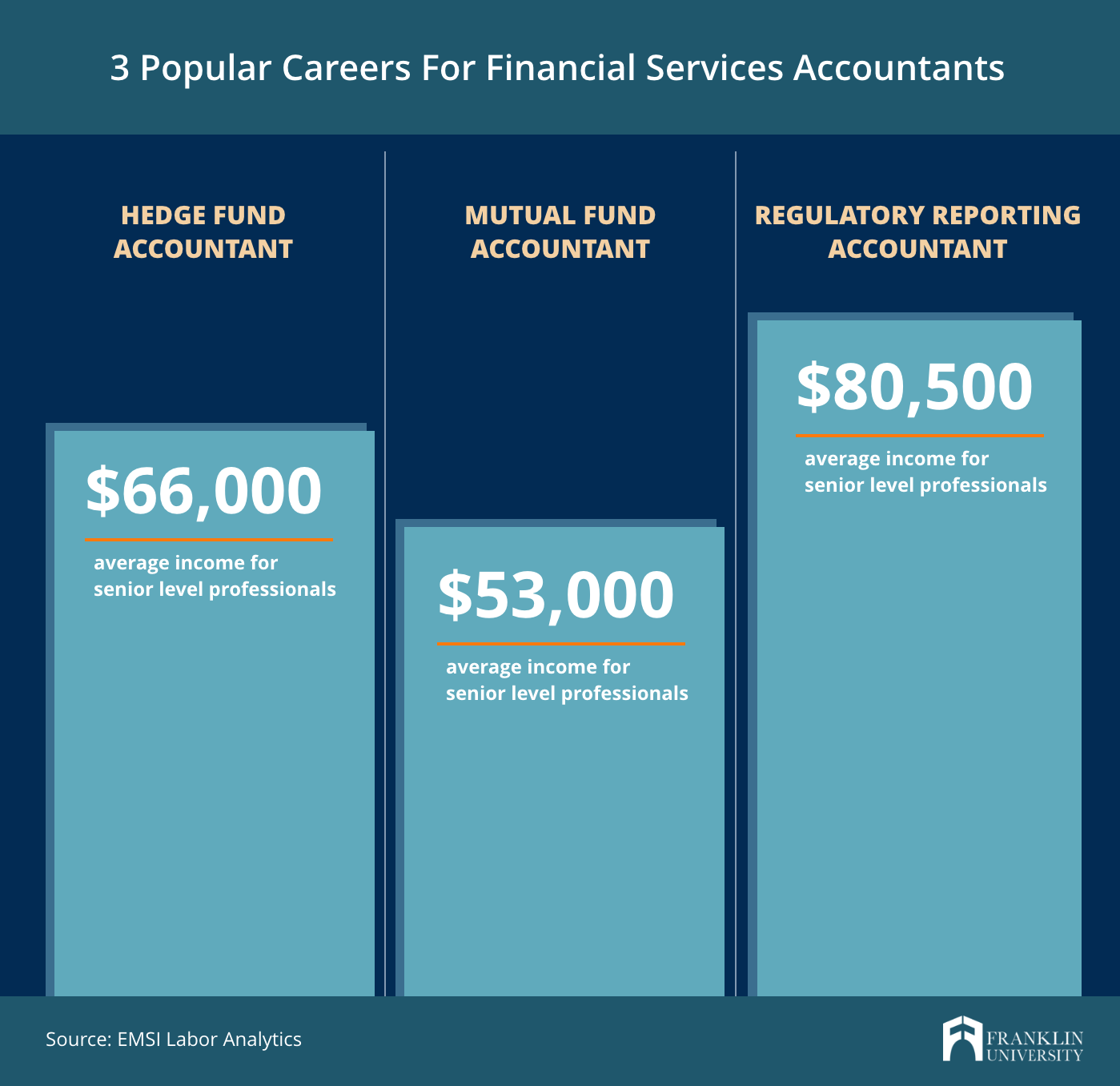

Three Careers in the Financial Services Sector

Financial services is one of the largest sectors of the American economy. As such, there are many opportunities for accountants to work within this sector. Let’s look at three of the most popular for entry- and mid-level professionals.

Hedge Fund Accountant

Hedge fund accountants provide accounting services and financial performance analysis to hedge funds, which invest on behalf of high-net-worth individuals and institutional investors. These professionals are responsible for preparing financial statements, maintaining general ledgers, and calculating net asset value. They also work strategically with portfolio managers to help develop investment strategies and improve various operations within the organization.

Day-to-day responsibilities include:

- Tracking and documenting cash flow between assets.

- Creating reports detailing fund performance to investors.

- Preparing necessary documentation for yearly audits.

Necessary characteristics:

- Strong time management skills

- Clear and concise communicator

- Adaptable to change

| Job Level | Median Salary |

| Entry-Level (1-3 years) | $51,000 |

| Senior-Level (3-5 years) | $66,000 |

Mutual Fund Accountant

Mutual fund accountants are responsible for monitoring, evaluating and reporting investment fund performance. A large portion of their responsibilities include creating standard daily, weekly or monthly financial statements.

Day-to-day responsibilities include:

- Preparing journal entries and performing reconciliations.

- Ensuring all financial activities are accurately captured for reporting and tax purposes.

- Providing internal reporting to aid in improving investment strategies.

Necessary characteristics:

- Ability to distill crucial details from vast data

- Dedication to accuracy

- Strong interpersonal communication

| Job Level | Median Salary |

| Entry-Level (1-3 years) | $48,000 |

| Senior-Level (3-5 years) | $53,000 |

Regulatory Reporting Accountant

These accountants take the lead on completing and submitting regulatory reports to the necessary agencies. In addition to accounting skills, they must be subject matter experts in the regulatory requirements of governing bodies and stay up-to-date with regulation changes.

Day-to-day responsibilities include:

- Preparing and filing of various financial regulatory reports.

- Maintaining financial data quality control.

- Performing reconciliations to support data validity in the event of an audit.

Necessary characteristics:

- Strong time management skills

- Exceptional attention to detail

- Innate curiosity and desire to learn more

| Job Level | Median Salary |

| Entry-Level (1-3 years) | $61,750 |

| Senior-Level (3-5 years) | $80,500 |

Kick-start a Rewarding Accounting Career

The first step to a long-term career in accounting is getting your bachelor’s degree in accounting. If you’re a working professional balancing your career with pursuing an education, you need a program that will meet your unique needs.

Franklin University offers a 100% online B.S. in Accounting program that will help you master industry best practices, innovative accounting software and the soft skills needed to excel. The industry-aligned curriculum will also prepare you for professional certification while you earn your degree.

Learn more about the Franklin accounting program and how it can help you build a rewarding career.