Request Information

We're Sorry

There was an unexpected error with the form (your web browser was unable to retrieve some required data from our servers). This kind of error may occur if you have temporarily lost your internet connection. If you're able to verify that your internet connection is stable and the error persists, the Franklin University Help Desk is available to assist you at helpdesk@franklin.edu, 614.947.6682 (local), or 1.866.435.7006 (toll free).

Just a moment while we process your submission.

Bookkeeping Certification: 5 Big Questions Answered

Bookkeeping is a critical function for any business or organization because financial health should inform every decision. However, not all bookkeepers have the necessary skill set to interpret data in ways that help businesses drive peak performance. That's where earning a bookkeeping certification can make a big difference.

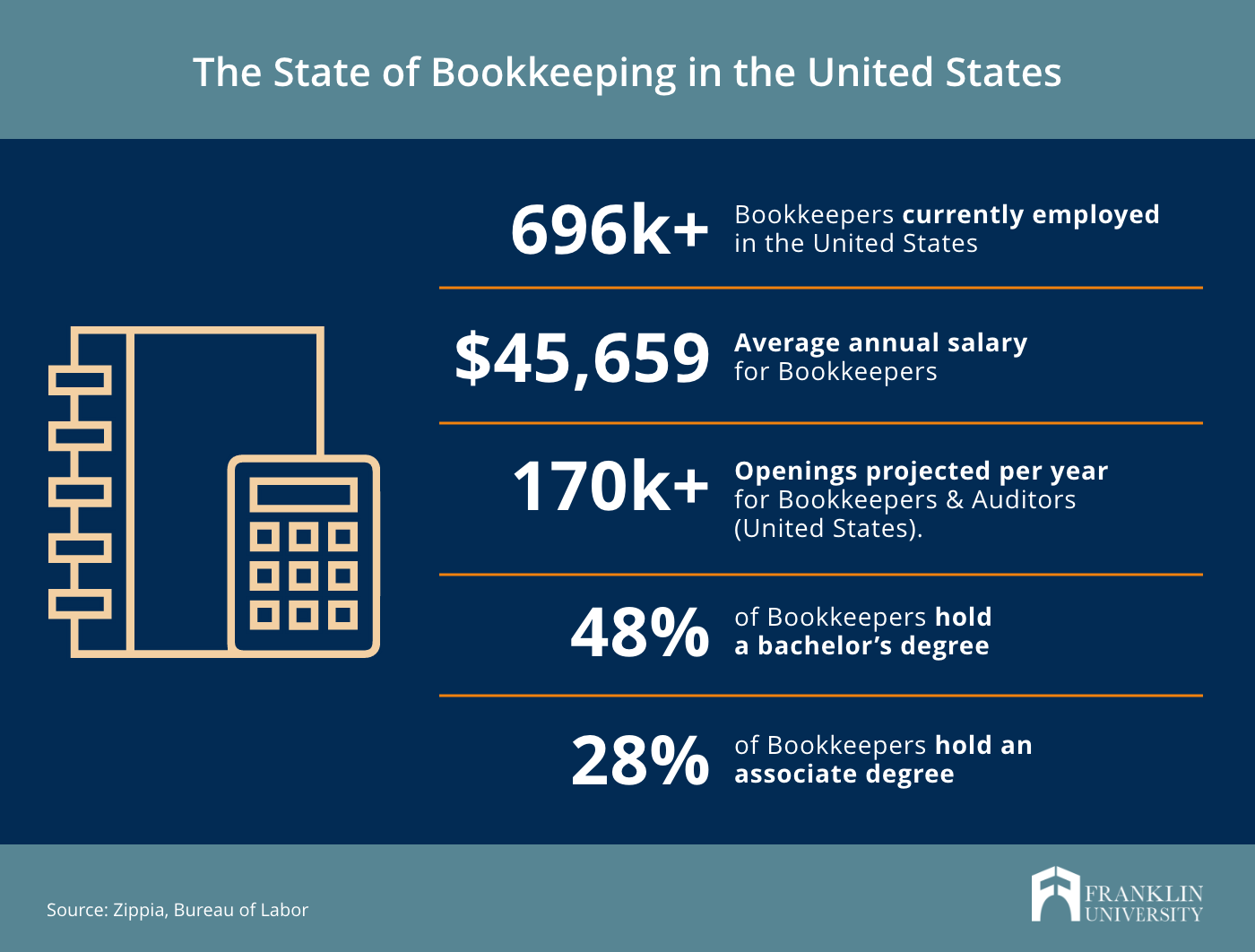

According to the Bureau of Labor Statistics, about 170,200 openings for bookkeeping, accounting and auditing clerks are projected each year, on average, over the decade. Bookkeepers who earn professional certifications have an edge.

"Many people claim to be bookkeepers, but a certification demonstrates that an individual has the skills required to produce accurate financial data," said Annette Hoelzer, MT, CPA, Lead Faculty of Accounting at Franklin University. "A person certified in bookkeeping is demonstrating that they are at the top of their profession—similar to CPAs being the best in the accounting field."

Every organization needs someone to record financial transactions accurately, but that's just the start. Bookkeepers looking to make an impact within an organization and advance their careers need to demonstrate their value in many ways. Earning a certification is a great place to start.

Ready to make your move in accounting? Gain insights for every career stage in our free Accounting Career Guide.

1. What Qualifications Are Needed To Become a Bookkeeper?

At their core, bookkeepers produce financial records for organizations. It's a profession that requires meticulous records and extreme attention to detail—because accuracy matters. For example, accurate records are essential for tax preparation and assessment of the performance of a business. In addition, business owners and organizations depend upon accurate bookkeeping as a basis for their decision-making.

According to leading labor analytics firm EMSI, requirements to become a bookkeeper frequently include hard skills in accounting, accounts payable and receivable, finance, data entry, auditing, billing and financial statements. It’s a sizable list where candidates benefit from investing in courses that show a commitment to the profession. For example, bookkeepers should know how to work with existing and emerging software including Microsoft Excel, Payroll and Quickbooks.

"While bookkeepers don't necessarily need advanced degrees, they do need to learn the tools and technologies that make bookkeeping possible," said Hoelzer. "Those skills are beneficial to employers for which they may be willing to pay higher salaries."

2. What Is A Bookkeeping Certification?

A bookkeeping certification is a professional designation that indicates a person's skill level in bookkeeping subjects related to managing a company's financial statements and transactions. Certificates can be earned through colleges or accredited professional societies.

By investing in certification, bookkeepers create opportunities for career growth and financial reward. While the median pay for bookkeepers is $40,000 a year, professionals who can demonstrate skills in helping employers manage their businesses could earn much more. So while bookkeepers don't need to earn certification to be employed, investing the time to earn credentials can help by creating job opportunities and expanding earning potential.

3. What Are The Most Popular Bookkeeping Certification Programs?

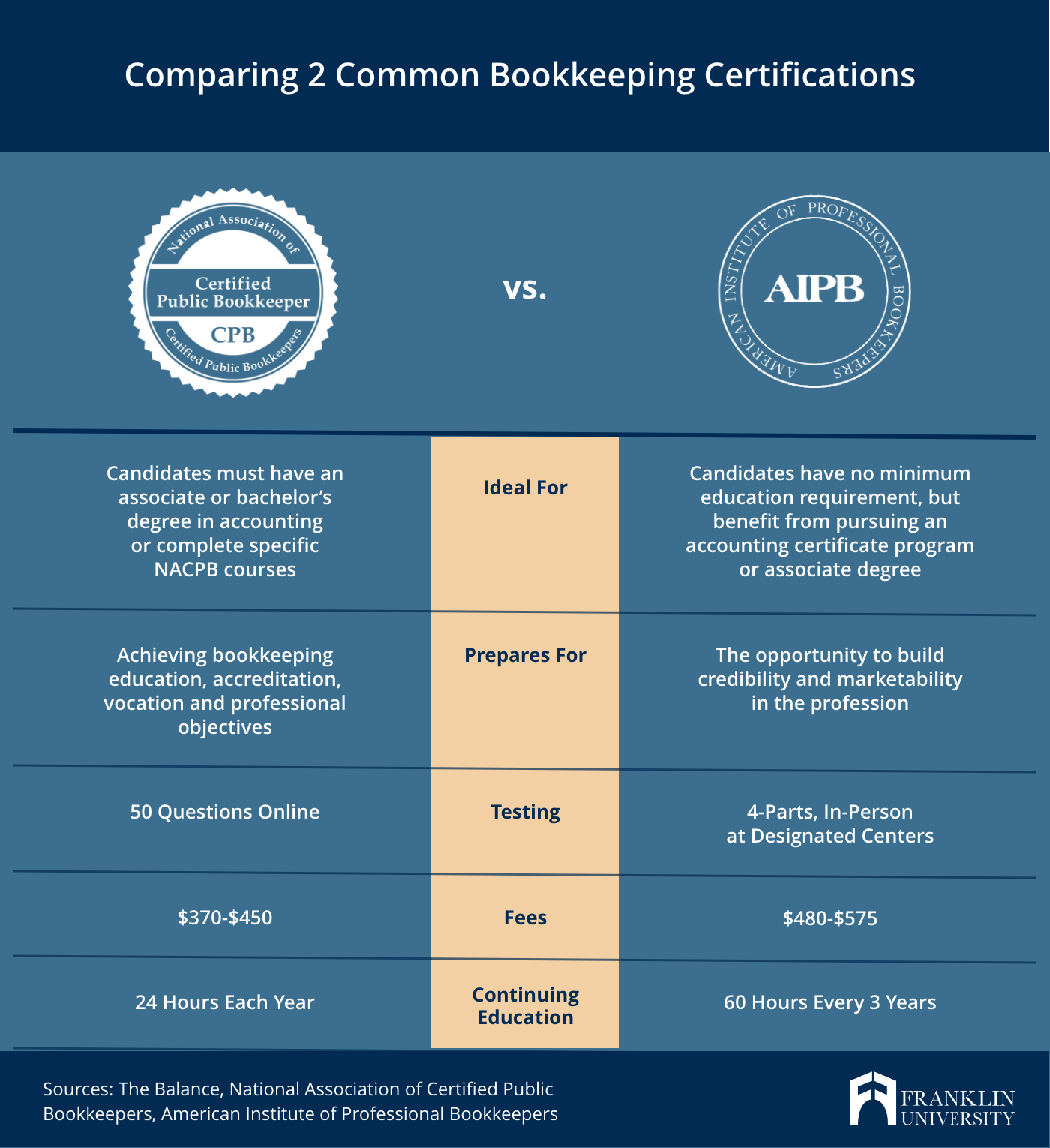

When it comes to bookkeeping certifications, two programs continuously rise to the top for being nationally recognized: the National Association of Certified Public Bookkeepers (CPB) and the American Institute of Professional Bookkeepers (AIPB).

National Association of Certified Public Bookkeepers

NACPB is best suited for people with a bachelor's or associate degree in accounting. The certification is recognized throughout the United States and its properties and assures employers of bookkeeping knowledge and skill. Candidates need to pass a formal exam, agree to abide by the Code of Professional Conduct, conduct continuing education courses annually and apply for licensure. The certification can also be issued through work experience equivalent to 4,000 hours as a bookkeeper or accountant.

American Institute of Professional Bookkeepers

AIPB is best suited for people with no formal education but at least two years of experience in the field. Courses prepare candidates for the national Certified Bookkeeper (CB) exam, which tests knowledge of payroll, depreciation, inventory and much more. In addition, candidates must submit an application, meet work experience requirements, pass a four-part exam, adhere to the Code of Ethics, and complete 24 hours of continuing education annually.

"While at one time earning a certification was optional, it's now becoming a mandatory qualification on job descriptions," said Hoelzer. "Employers seek highly qualified and skilled bookkeepers who can provide added value."

4. Are There Microcredentials for Bookkeeping?

Microcredential programs allow professionals to attain new skills without pursuing collegiate study. The programs are often entirely online, providing easy and convenient access to educational materials, testing platforms, and more.

For example, at Franklin University, students can earn accounting-related professional certificates through the FranklinWORKS Marketplace, including programs in Microsoft Excel Skills and Intuit Bookkeeping. These certificate programs equip professionals with the skills they need to do their job well and stand out among other job candidates.

Students who pursue certificates like these will acquire career fortifying skills.

- Students develop the ability to interact with, organize, and think critically about data information.

- They build data-informed financial decision-making models for tax, audit and managerial decision-making.

- Over time, they determine the root cause and solutions to business financial problems based purely on data analysis.

- Finally, they design new business processes and efficient systems.

These 100% online certificate programs are perfect for candidates who want to boost their accounting career, prepare for the CPA exam or better understand how data analysis capabilities can enhance various accounting roles. It’s a smart investment in professional development, and what’s more, it can be completed in less than one year.

5. Why Should You Earn a Bookkeeping Certification?

Bookkeepers who invest in continuing education and certification increase their marketability in the industry. Employers seek the best talent, and certification signals a commitment to the profession and continuing excellence.

- Certification allows bookkeepers to understand data collection and interpret data in ways that help leaders make informed decisions.

- Employers are increasingly adding certification to job requirements, presenting opportunities for those who invest in continuing education.

- Many people claim to be bookkeepers, but certification demonstrates that an individual actually has the skills required to produce accurate financial information.

- Earning a certification demonstrates that a person is at the top of their profession and a high performer eligible for pay and opportunities.

- Bookkeeping technology continuously changes, and people with certifications know and understand the latest software.

Businesses and organizations will always need competent and accurate bookkeepers, and certification is the best way to advance in the profession. Franklin University's Accounting Data Analytics Certificate equips bookkeepers to succeed in their current jobs and present opportunities for advancement.

Franklin also offers degrees in accounting, helping students speak the language of business. The B.S. Accounting degree provides the full range of skills employers desire in such areas as financial reporting and analysis, managerial accounting, auditing ethics and financial management.