Request Information

We're Sorry

There was an unexpected error with the form (your web browser was unable to retrieve some required data from our servers). This kind of error may occur if you have temporarily lost your internet connection. If you're able to verify that your internet connection is stable and the error persists, the Franklin University Help Desk is available to assist you at helpdesk@franklin.edu, 614.947.6682 (local), or 1.866.435.7006 (toll free).

Just a moment while we process your submission.

Nonprofit vs. For-Profit College: What’s the Difference?

When it comes to colleges, it’s easy to confuse the terms “nonprofit” and “for-profit. But because your choice of school can affect the quality and value of your degree, you’re going to want to learn more about them.

More importantly, you’re going to see just how different they are from one another–not just in how they operate, but why.

What Is a Nonprofit College?

A nonprofit college or university is an institution that is dedicated to student learning. Because they aren’t concerned with making a profit or pleasing the interests of revenue-focused shareholders, a non profit college is free to focus on creating and delivering a high-quality education.

What Is a For-Profit College?

A for-profit college is an institution that operates like a business. Its focus and first priority is on earning a profit for their shareholders and meeting the needs of their stakeholders.

When it comes to paying for school, grants are among your best options. But do you know how to find them? Remove the guesswork by downloading this free guide

What Is an Online College?

If the terms “nonprofit” and “for-profit" weren't confusing enough, some people throw in the term “online college” and muddy things even more.

To be clear, online colleges are not exclusively for-profit schools. While for-profit colleges may have added to the popularity of online learning, so did a global pandemic.

The truth is, as technology has evolved, distance learning has, too. As online learning became more available that, of course, added to its popularity.

Today, most nonprofit colleges and universities offer some type of distance learning program, giving adult students the flexibility and convenience they need to go to school and still have a job, a family and a life.

According to labor analytics firm Lightcast, of the 5.3 million degree program completions in 2021, almost one-third (31%) were distance-offered (also known as online) programs.

Nonprofit College vs. For-Profit College: 4 Key Differences

Investing in yourself and your future is obviously a big decision that requires careful consideration and planning. Taking the time to understand the major differences between schools can help you decide which is better, a nonprofit or for-profit college.

Mission

Nonprofit colleges and universities have a long, reputable history of excellence. The mission of nonprofit colleges and universities was and continues to be pure and simple: ensure student success by providing a high-quality education and a positive student learning experience.

While you would think that for-profit colleges would have the same mission, the truth is that they don’t. These institutions prioritize generating a profit from their students and sharing those profits with their shareholders.

It should be noted that for-profit colleges are relatively new compared with nonprofit institutions. They emerged in the 1970s and in recent years have made the headlines as some have been found to be financially irresponsible and guilty of student fraud. As a result, there continues to be a national call for more transparency and accountability among for-profit schools.

Governance

Nonprofit colleges are independently operated. Some, like Franklin University, are directed by a Board of Trustees who have strong ties to the local community. They also may seek input from community leaders through advisory groups and alumni boards. This governance system helps ensure that the needs of students are met and that a quality education is provided.

For-profit colleges are quite the opposite. They operate under an ownership structure and are often subsidiaries of larger corporations or groups–groups that are dedicated to serving multiple constituencies. In fact, the majority of for-profit colleges are traded on the major stock exchange or owned by private equity firms that are focused on profitability.

Funding

Quality nonprofit colleges and universities are transparent about the costs and fees of their degree programs. Their funding comes, in part, from student tuition and fees, as well as from private donors, endowments, and state and federal grants and awards.

At nonprofit colleges, revenue must be reinvested into the institution–whether that’s improving operations, instructor salaries, library resources or student services–to fulfill its educational mission.

At for-profit colleges, a significant portion of tuition revenue goes directly to investors or other non-education related spending, including advertising and marketing to attract more students. For-profit colleges stay in business only by creating a positive return on investment or ROI.

Student Instruction and Education-Related Spending

According to the College Board, a nonprofit organization that connects students to college opportunities, for-profit colleges often come at a higher cost and the credits earned often don’t transfer to other colleges. That’s because the goal and focus of for-profit colleges is earning a profit for their shareholders.

Moreover, there’s data to back up how much of your tuition dollars go directly to student instruction and education-related spending. The Century Foundation (TCF) found that for-profit colleges spend the least on instruction–less than 50% of overall tuition revenue.

In contrast, TCF reports that nonprofit college instructional spending varies by school, however, many spend more than $20,000 per student–even if they don’t charge that much in student tuition, thanks to donated funds, such as endowments.

Tuition & Fees

There are two ways to look at the cost of college: published tuition and fees and net tuition and fees.

- Published tuition and fees are the total cost of attendance before any financial aid is factored in.

- Net tuition and fees are a college’s published “sticker price,” including tuition and fees minus any grants, scholarships, or education tax benefits you receive. Some net tuition and fee statistics take loans into account, too.

The Cost of Borrowing to Pay for Your Degree

The College Board’s Trends in College Pricing and Student Aid 2021 reports that:

“Students who earn their bachelor’s degrees at for-profit institutions are more likely to borrow and accumulate higher average levels of debt than those who graduate from public and private nonprofit four-year colleges.”

Completion Rates

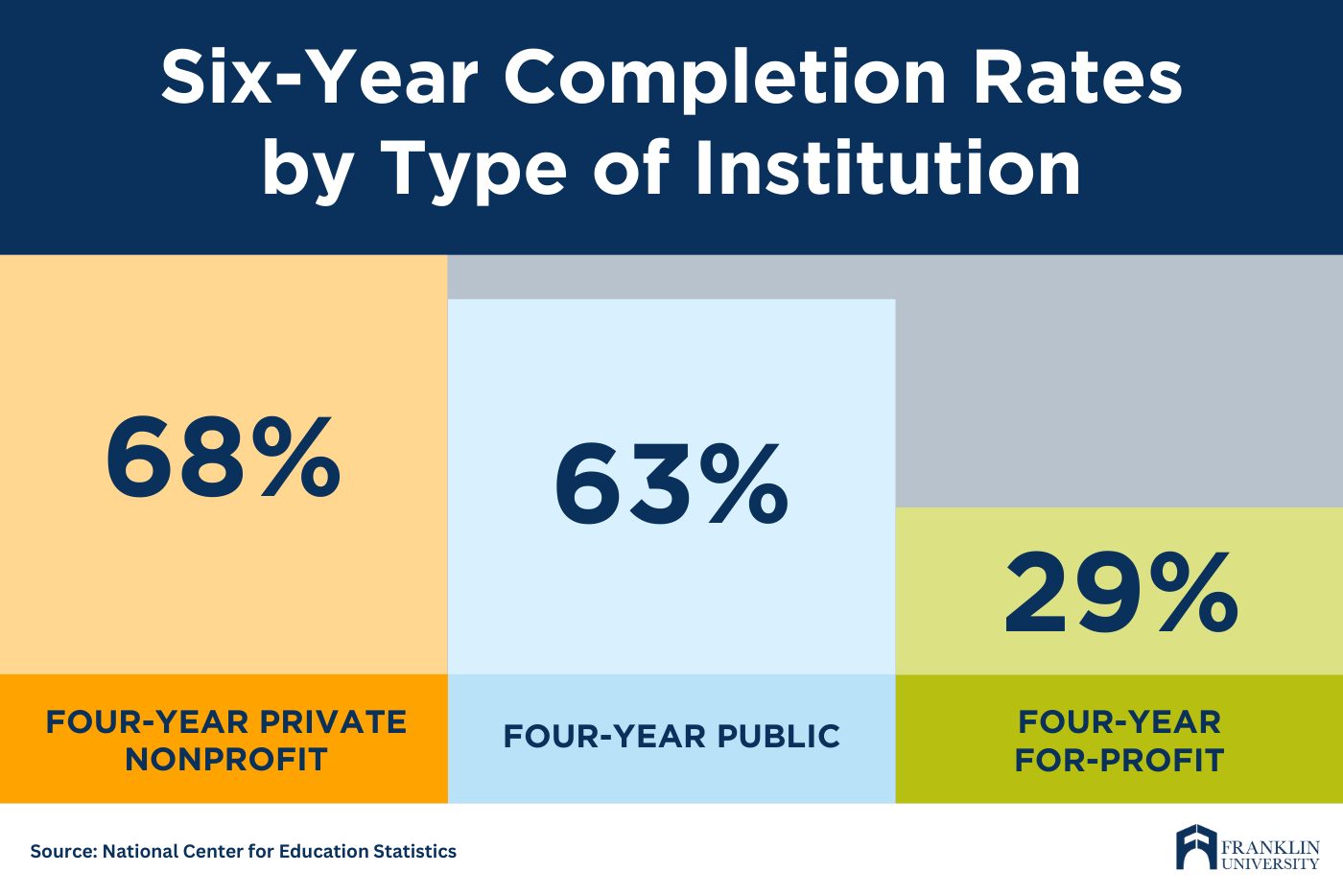

The difference between graduation rates at four-year nonprofit schools and four-year for-profit colleges speaks for itself. This is due, in part, to the way programs are structured with more flexibility and accountability, as well as the availability of student support services.

According to the National Center for Education Statistics (NCES), four-year private nonprofit schools have a 68% completion rate. Four-year public schools come in a close second with a 63% completion rate and four-year for-profit schools come in at the bottom with a 29% graduate rate.

Should I Go to a Nonprofit College or a For-Profit College?

If you’re looking to earn a college degree online and are considering both nonprofit universities with for-profit colleges, you’ll want to consider the quality of the education.

- Review the college or university’s accreditation status. You can check their respective websites or, better, yet, search the U.S. Department of Education’s accreditation database.

- Dig into each school’s graduation rates and employment data. The American Institutes for Research (AIR) tracks students after graduation and compiles data on postsecondary and workforce outcomes.

- Take a close look at your school’s curriculum. Institutionally accredited schools are held to high and rigorous academic standards. Don’t forget to look at your instructors. Find out if you’ll be learning from exemplary professionals who bring deep experience and passion for learning to your student experience.

- Talk with colleagues and mentors about their college experience. Of course, the final decision about whether you should go to a nonprofit or for-profit college is yours. But, it can help you make a more informed decision if you get insight from people you already know and trust.

So, now that you know the differences between nonprofit and for-profit universities, and you’ve narrowed your choices down to the ones that will ensure a high-quality education, there’s just one more thing to do: choose the degree program that will give you the knowledge and skills to reach your career goals.

Franklin University is an institutionally accredited university that’s dedicated to the success of nontraditional students–especially professionals who want the flexibility to earn a high-quality online degree without taking time out from their career.

Explore Franklin University’s degree programs to see how they can help you reach your professional goals.