Request Information

We're Sorry

There was an unexpected error with the form (your web browser was unable to retrieve some required data from our servers). This kind of error may occur if you have temporarily lost your internet connection. If you're able to verify that your internet connection is stable and the error persists, the Franklin University Help Desk is available to assist you at helpdesk@franklin.edu, 614.947.6682 (local), or 1.866.435.7006 (toll free).

Just a moment while we process your submission.

What Is an MBA in Finance?

Every business—no matter its size or industry—needs solid financial planning and management to succeed. It’s no surprise that financial leadership positions are in high demand. According to Lightcast, from 2022-2032, finance jobs are expected to grow an impressive 10.9%.

High-level finance positions require significant expertise and specific technical skills. One way to gain those skills and obtain the qualifications you need for a well-paying position in this field is to earn a Master of Business Administration (MBA) with a specialization in finance.

What Is an MBA in Finance?

MBA programs prepare professionals for advancement in a wide range of fields. Typically, MBAs focus on developing leadership skills, strategic thinking and general business knowledge. Professionals who are ready to move into management or a higher-level role often use MBAs as a launchpad into those positions.

MBAs with a specialization in finance include the elements of a general MBA program, giving students foundational knowledge in business strategy, human resources, marketing and more. However, they go deeper into the specifics of financial leadership than general MBA programs, with more advanced coursework in areas like financial modeling, accounting and analysis.

How Long Does an MBA in Finance Take?

MBA programs vary in length depending on the school, with full-time programs typically taking one to two years. However, some schools offer more flexible options. Franklin University’s MBA with a specialization in finance is designed for working professionals and takes as little as 12 months.

What Are the Admissions Requirements for an MBA in Finance?

Before you apply to an MBA program, you’ll need a bachelor’s degree in any field from an accredited college or university. Some business schools require GMAT scores, prerequisite coursework, or a certain amount of work experience to apply. Franklin’s program does not require test scores, prerequisites, or specific work experience. Instead, applicants with at least a 2.75 GPA from their undergraduate institution are invited to apply for individual consideration.

What matters most when choosing a master’s program? Compare features, benefits and cost to find the right school for you.

What’s the Difference Between an MBA in Finance and a Master of Finance?

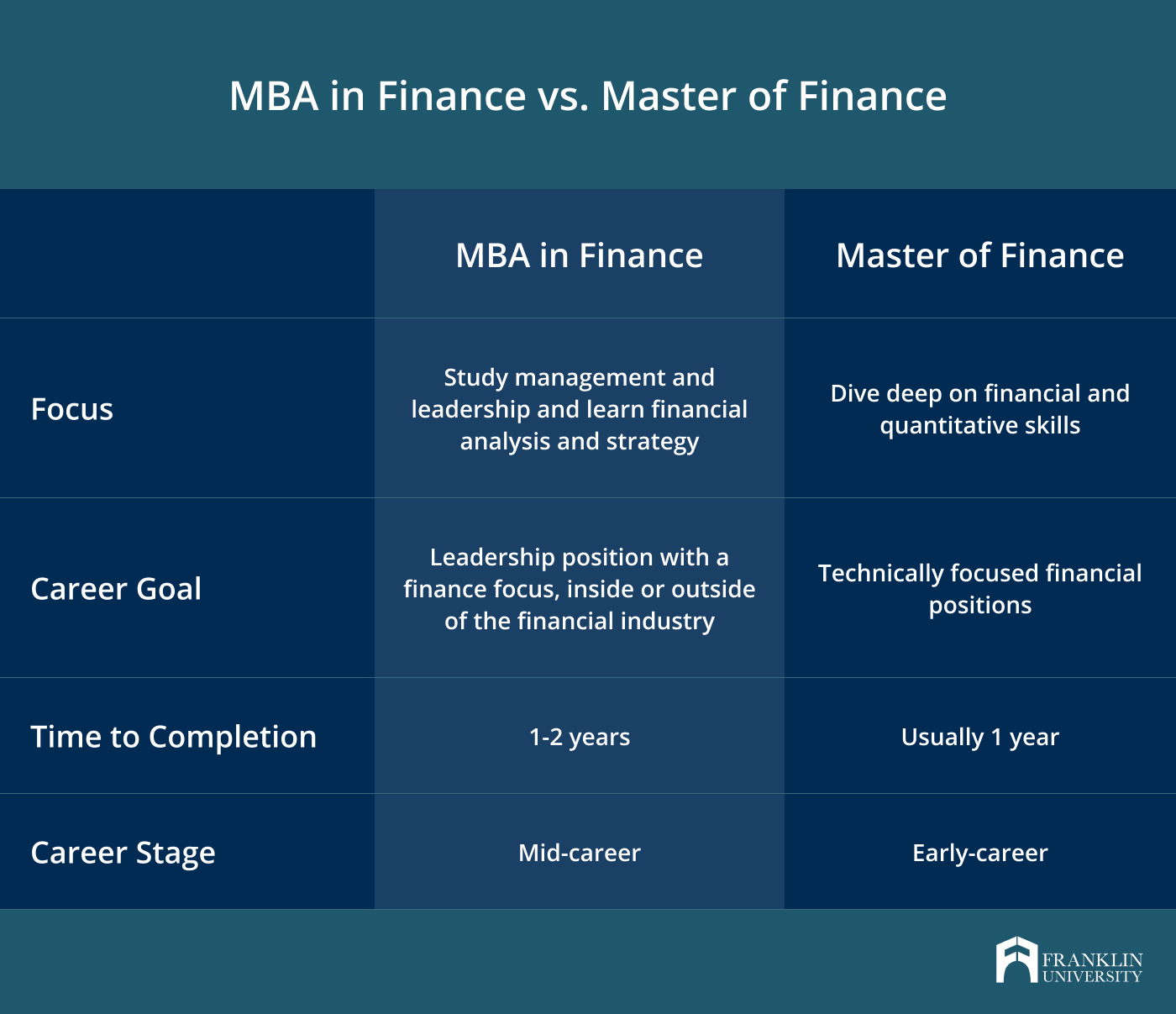

Students who wish to pursue a career in finance often choose between an MBA in finance and a Master of Finance degree. While both degrees provide a solid grounding in financial principles, they do have important differences.

The primary differentiator is that an MBA in finance maintains a strong leadership focus, meaning that students in the program explore the full range of challenges that a CEO or chief financial officer might take on. Often, students enter MBA programs with some career experience, while master of finance programs tend to draw newer entrants to the workforce.

“An MBA in finance is a degree geared toward individuals wanting to take management courses in finance and expand their finance analytical and strategic skills,” explains Dr. Kristin Martin, chair of Franklin’s MBA program. “The finance specialization provides a well-balanced curriculum, including courses that combine management and quantitative skills. An MBA in finance will assist in building your management skills while preparing you for work in the financial realm of any company, especially the financial industry.”

While Franklin’s MBA in finance program incorporates courses in financial theory, mathematics, quantitative finance, investments, markets, financial reporting and analysis and valuation, the Master of Finance delves deeper into those topics.

The choice between the two degrees depends entirely on your preferences and goals. The Master of Finance degree may be a better choice if you wish to work in a technical role in the financial industry. In comparison, the MBA in finance is likely a better choice if you hope to attain an executive leadership position eventually.

What Do You Learn from an MBA in Finance?

If you embark on an MBA in finance at Franklin, you’ll learn a wide range of general management and specific financial skills.

Management Skills

- Effective communications: Learn to communicate your strategy and critical milestones effectively with stakeholders, from boards of directors to employees across the organization.

- Managerial economics: Understand and apply foundational economic concepts like market demand, supply, equilibrium, marginal analysis, production, costs and revenue.

- Financial and managerial accounting: Explore corporate governance, asset protection and advanced accounting topics.

- Marketing management: Learn to work closely with your marketing team to apply innovative strategies and to develop product, pricing and promotion strategies in line with consumer behavior.

- Human resources management: Prepare to collaborate with your human resources team to develop effective strategies to engage and inspire employees across the organization.

- Business strategy: Develop the ability to formulate and enact organizational strategies that keep your company ahead of the competition.

Advanced Financial Skills

- Corporate finance: Refine your understanding of the U.S. financial system as well as strategies for capital budgeting, capital structure, and evaluation of investment opportunities.

- Advanced investment: Develop the advanced knowledge of capital markets, financial institutions and analytical tools needed to manage portfolios. Utilize computer simulations and models to build hands-on investment skills.

- Global finance: Prepare to manage corporate finances in a global context by delving into topics like exchange rate risk management, cross-border investment strategies and participation in international money and capital markets.

What Can I Do with an MBA in Finance?

An MBA in finance is a highly versatile degree inside and outside the financial services industry. Whether you aspire to a financial leadership position in a global company or manage corporate investment portfolios, having an MBA is a valuable asset. Typically, graduates of MBA in finance programs take on roles that involve significant financial oversight. They also often take responsibility for strategic decision-making.

Common MBA in finance jobs include:

- Chief executive officer (median salary: $179,525)

- Financial manager (median salary: $131,706)

- Financial and investment analysts (median salary: $91,582)

- Personal financial advisors (median salary: $94,162)

- Other financial specialists (median salary: $73,237)

All salary data provided by Lighthouse.

Learn more about what an MBA in finance is used for.

Is an MBA in Finance Worth It?

These days, competition is fierce for higher-level managerial positions—especially executive roles. While a bachelor’s degree might get you in the door to a company, an MBA in finance can help you stand out in crowded candidate pools.

As Dr. Martin explains, “An MBA with a specialization in finance can set you apart from applicants with similar work experience, especially those seeking finance leadership positions.”

In addition to helping you achieve a higher title, earning an MBA often comes with a significant salary boost. According to Lightcast, in 2022, positions with advertised salaries in business, management and financial operations that required an MBA paid a median of $120,200 per year. Advertised jobs in those same fields that only required a bachelor’s, on the other hand, paid a median salary of $80,300.

MBA programs also offer a unique opportunity to build your professional network. While earning your degree, you’ll develop relationships with faculty and experts in your field, as well as future colleagues. For many students, these connections provide an entry point into new companies and industries..png)

Advance Your Career with an MBA in Finance at Franklin

Ready to invest in your long-term potential with an MBA in finance? Franklin’s degree program is delivered 100% online, offering unmatched flexibility for professionals ready to take the next step in their careers. Take courses at your own pace to fit your schedule and budget, and complete your degree in as little as 12 months.

Our curriculum is designed by a diverse array of business and industry leaders and delivered by faculty who are practitioners in the field. Join optional synchronous sessions with faculty, guest speakers, and classmates to ask questions and dig into challenging topics. When you need support, we’re here to help. Your future starts here.

Learn more about how an MBA in Finance at Franklin can help you meet your career goals.