Request Information

We're Sorry

There was an unexpected error with the form (your web browser was unable to retrieve some required data from our servers). This kind of error may occur if you have temporarily lost your internet connection. If you're able to verify that your internet connection is stable and the error persists, the Franklin University Help Desk is available to assist you at helpdesk@franklin.edu, 614.947.6682 (local), or 1.866.435.7006 (toll free).

Just a moment while we process your submission.

Can You Get Financial Aid for a Master's Degree?

Getting a master's degree is a milestone achievement. It’s one of those things that does something for you as a person and for you as a professional.

Not only can earning your master’s be a major personal accomplishment, it can elevate your career – and your salary.

What Is the ROI on a Master’s Degree?

It turns out that education really does pay, both in terms of earnings and employability. In fact, according to the U.S. Bureau of Labor Statistics (BLS), higher education levels equate to less unemployment. As an example, high school graduates average a 4% unemployment rate whereas those with a master’s degree average a mere 1.9% unemployment rate.

The BLS also reports that the average annual salary for those with a master's degree is $86,372. Compare that to $74,464 for a bachelor’s, $52,260 for an associate, and $48,620 for some college, no degree, and it’s easy to see how quickly those thousands a year could add up to a million or more over the course of your career.

Now that you know the potential ROI of a master’s degree, the next question is, how do you pay for grad school – especially since, according to the Education Data Initiative (EDI), the average cost of earning a master’s degree is $62,650.

Good news. There are quite a few options for paying for grad school, including financial aid. Keep reading to learn more about your financial aid options, including alternatives to student loans.

What matters most when choosing a master’s program? Compare features, benefits and cost to find the right school for you.

Can I Get Financial Aid for Grad School?

“Yes, graduate students can get financial aid,” says Sam Selvage, MBA, assistant director of financial aid at Franklin University. “Federally, there is no free money for graduate students, but there are loans and other options available that can help you pay for grad school. Remember, student financial aid includes any federal and private loans to students, as well as federal, state, local or institutional assistance.”

Why You Should Complete the FAFSA If You’re Planning to Go to Grad School

As a potential graduate student, you’ll want to find out what type of financial aid you may be eligible for. How? By completing the Free Application for Federal Student Aid or FAFSA.

Unfortunately, many graduate students don’t think the FAFSA applies to them, so they fail to complete it. But that’s a mistake.

“Do a FAFSA,” Selvage explains. “While generally you’re looking at loans for a master’s degree, Step 1 is always the FAFSA. Typically, you can apply in October of every academic year, however, the FAFSA Simplification Act had an impact on the availability of the FAFSA starting with the 2023-2024 school year. Just be sure to check the deadlines for each academic year.”

Remember, the FAFSA enables you to be considered for federal and state financial aid based on income and other information. As a graduate student you’re no longer considered a dependent. That means your income (and your spouse’s, if you’re married) are evaluated independently of a parent or guardian. And that’s good news because you could be eligible for even more financial aid to help pay for grad school.

Financial Aid: Grad School Loans

If you’re looking for money to pay for grad school, there are two types of federal student loans that you can apply for. Keep in mind that loans are different from grants. Loans must be repaid, whereas grants do not need to be paid back.

There are the two types of students loans available to graduate students:

- Direct Loan: There are two types of federal student loans offered by the U.S. Department of Education: (1) direct subsidized loans and (2) direct unsubsidized loans. Both help eligible students pay for school. Both require you to complete the FAFSA. The only difference is that a subsidized loan offers slightly better terms to help students who have a demonstrated financial need.

- Grad PLUS Loan: This is a supplemental loan you can get if you need additional funding to pay for, say, living expenses or a heavy course load. It’s considered supplemental because it’s designed to fill in the gaps if you’ve maxed out your eligibility for federal direct student loans. The Grad PLUS loan is credit-based, albeit somewhat loosely. This means you cannot have a bankruptcy on your credit history, so neutral or good credit is necessary for approval. It does have some eligibility limits, too, so be sure to check the terms and conditions.

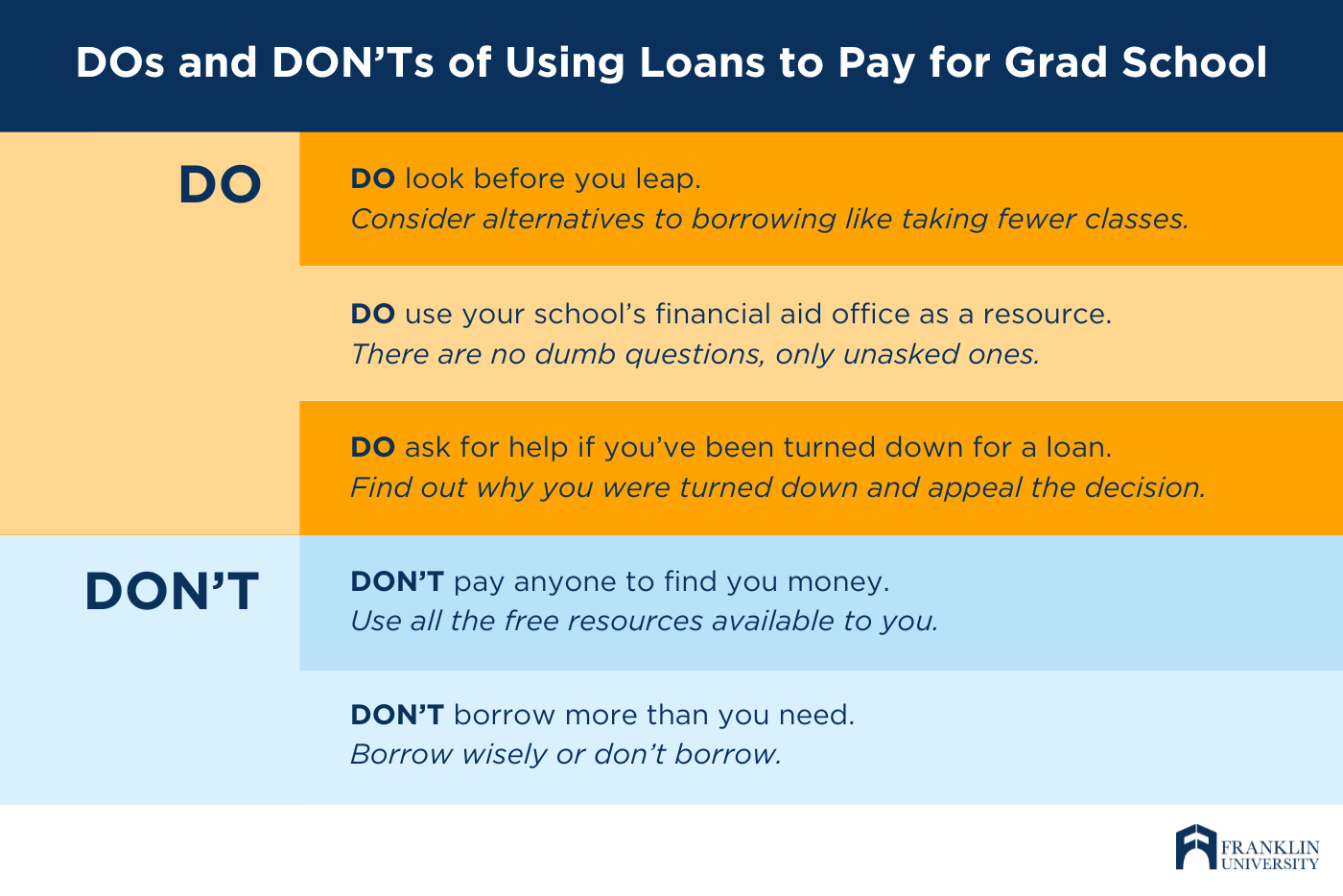

DO’s and DON’Ts of Using Loans to Pay for Grad School

Loans are a good option if you’re not able to cash-flow your graduate school tuition. But they come with challenges, too. Learn how to make the most of student loans for grad school with these pro tips from the financial aid staff at Franklin University.

DO look before you leap.

Consider alternatives to borrowing. For example, you might want to take classes part time or take courses at a slower pace so that you don’t max out your savings or bust your budget.

DON’T pay anyone to find you money.

“Never pay someone to find you money,” cautions Selvage. “If you are asked for money, don’t give it to them. There are too many free resources available so you really don’t need to pay someone. I once had a student pay for help and all they did was have them fill out the FAFSA. Technically, they did find them money because all you need is a FAFSA for a direct loan.”

DO use your school’s financial aid office as a resource.

School financial aid offices are staffed with people whose job is to answer your questions and point you to information and resources. Says Selvage, “There are no dumb questions, only unasked ones. If you have any concerns about anything, from the FAFSA to employer tuition reimbursement, reach out to your school’s financial aid office. It’s there to serve you.”

DON’T borrow more than you absolutely need.

“I tell students, no matter what, just borrow wisely,” says Selvage. “If you don’t need it, don’t borrow it.”

This is especially important if you already have student loan debt. Of course, whether or not to borrow is a highly personal choice, so, if you can avoid debit, by all means choose another option for financing your graduate education.

DO ask for help if you’ve been turned down for a loan.

“For borrowers who might have some dings on their credit, there are some things they can do,” says Selvage. “One is to appeal the decision. You’ll get notification about why you were denied so it pays to look closely at it. I’ve seen some strange denials, too. One was for a $15 library fine that got turned over to the credit bureau. The student paid the fine, appealed the decision, and was approved. Another thing you can do if you’re disqualified for a loan is get an endorser, which is just a fancy name for a credit-worthy cosigner.

6 Ways to Pay for Your Master’s (Without Taking Out a Federal Loan)

1. Personal Savings

While using your savings might be an obvious option, it’s also one of the best ways to defray tuition costs. If you can pay some portion of your graduate education out-of-pocket, then by all means, do so. Visit the Federal Student Aid website for some helpful budgeting resources.

2. Employer Reimbursement or Partnerships

Your employer may have tuition reimbursement benefits or a partnership with a local or national institution that lets you enjoy reduced tuition rates. By law, employers can pay up to $5,250 a year in education-related fees. Remember, even if your employer doesn’t advertise education reimbursement, it doesn’t hurt to ask. Just be sure you’re ready with a thoughtful and convincing argument for why your education should be funded and how it will benefit your employer.

3. Private Grants and Scholarships

While there aren’t any federal grants or scholarships for grad students, there are grants and scholarships through organizations, such as professional and civic organizations or even churches. Remember, grants and scholarships are essentially “free money” for college that does not need to be repaid.

“There are tons of grants and scholarships out there,” says Selvage. “It might only be a one-time thing or just a few hundred dollars, but any amount means you don’t have to spend it out of pocket.”

Selvage recommends searching for the keywords, “graduate scholarships.” Be sure to research any opportunities thoroughly to make sure they’re legitimate. A few of the most reputable online sources include Fastweb.com, Career One Stop’s scholarship finder, and GoGrad.

Keep in mind that you may need to answer quite a few questions when applying for a scholarship since many of them are based on such things as personal background, career field and professional affiliation.

4. Institutional Tuition Assistance

Many universities offer direct scholarships to their graduate students. Some institutional scholarships are based on financial need and others are based on merit. Franklin University, for example, offers $13 million annually in tuition assistance in the form of both scholarships and grants. Institutional aid varies widely, so be sure to ask your school about available funds.

5. GI Bill®

If you’re a veteran, service member or qualified dependent, you may be eligible for educational benefits under the GI Bill®. How much the Veterans Administration will cover depends on the number of classes you take and how much the school charges for each credit hour

6. Private Loans

Banks and other independent lenders offer private loans that can help you pay for your master’s degree. Private loans are subject to lender approval and credit checks. Consider these loans a last resort, especially since they typically don’t have the lower costs and flexible repayment options that federal loans do.

How to Afford a Master’s Degree

So, now that you know a lot more about paying for your master’s degree, there’s only one question left to answer: Is it possible to save money on grad school?

Yes. Why, it’s not only possible, it’s likely, especially if you follow the tips found in this article.

Keep in mind that grad school is an investment in your future. It offers a pretty solid ROI, too, especially as far as salary is concerned. And, depending on how much you spend on your education, you could be eligible for tax credits, so that can help with the ROI, too. Consult with a tax professional or visit the IRS website to better understand the tax implications.

The point is, grad school could be worth it to you–as long as you’re not paying for it the rest of your life.

So, choose a high-quality program with per-credit-hour rates, budget wisely, and use all the resources available to you. Then, before you know it, you’ll have your master’s and be on your way to a higher salary, bigger lifetime earnings, and a credential you can be proud of.

GI Bill® is a registered trademark of the U.S. Department of Veterans Affairs (VA). More information about education benefits offered by VA is available at the official U.S. government Web site at http://www.benefits.va.gov/gibill.