Request Information

We're Sorry

There was an unexpected error with the form (your web browser was unable to retrieve some required data from our servers). This kind of error may occur if you have temporarily lost your internet connection. If you're able to verify that your internet connection is stable and the error persists, the Franklin University Help Desk is available to assist you at helpdesk@franklin.edu, 614.947.6682 (local), or 1.866.435.7006 (toll free).

Just a moment while we process your submission.

Is a Finance Degree Worth It?

The fast-paced finance industry includes everything from banking and asset management to insurance, venture capital, and private equity. In 2018, these sectors combined to form 7.4%, or $1.5 trillion, of the U.S. gross domestic product (GDP).

As such a large part of our economy, the finance industry creates high demand for jobs. It also promotes intense competition.

For individuals with the right training and education, there is a multitude of rewarding career paths. But do you really need a finance degree to succeed, or will any degree do? If you choose to pursue a degree in finance, how do you know which one is right? It depends on the career you want—now and in the long term.

This article will break down the different types of finance degrees and jobs, making it easier for you to decide if a finance degree is worth it.

Which Type of Degree Will Get You Where You Want To Go?

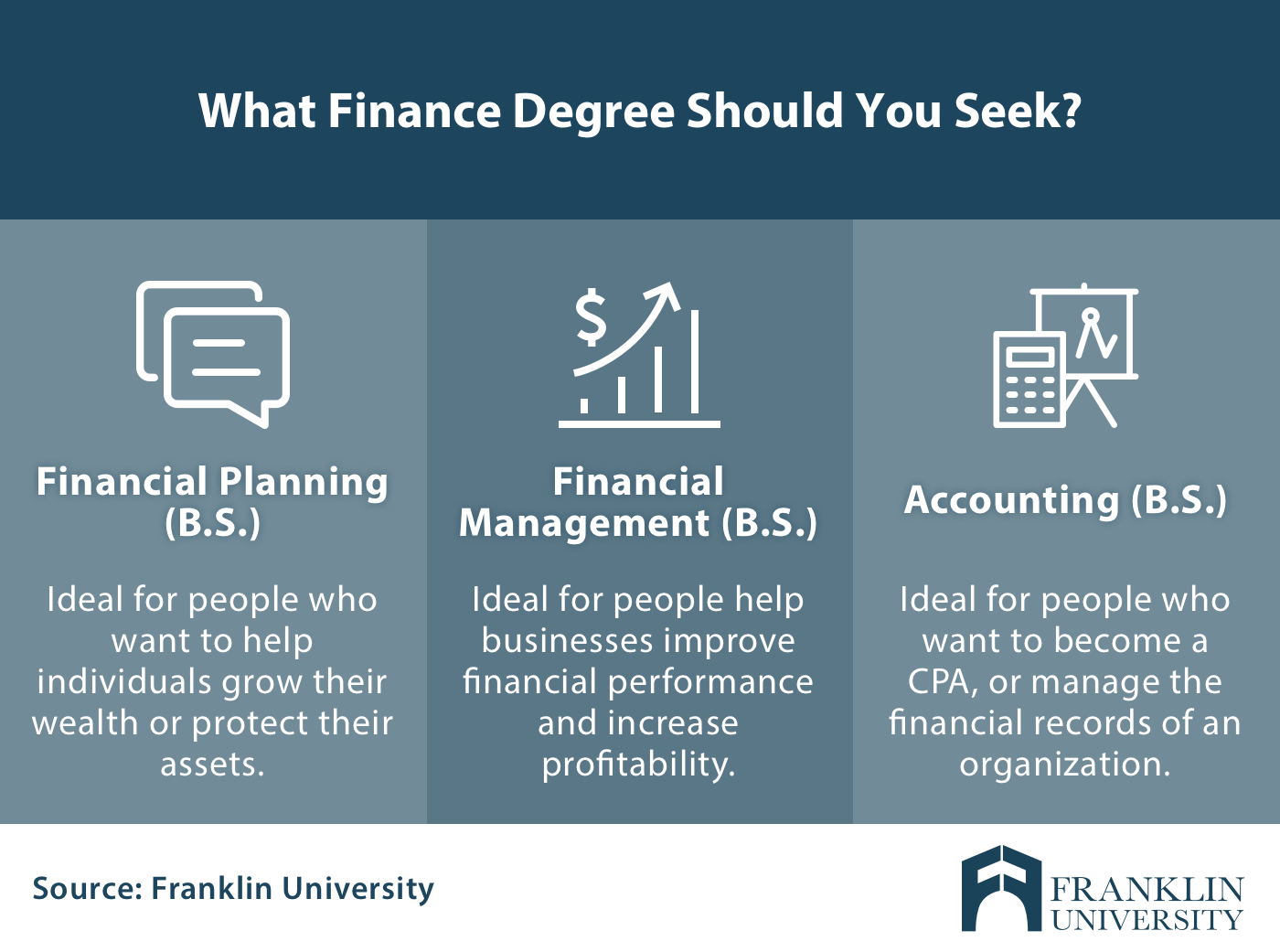

There are multiple undergraduate degrees that fall under the category of finance. Many of these degrees have similar foundational business courses in areas like accounting, business law, management, and economics. Where they differ is in their major courses, which allow for additional specialization within the field of finance.

These are three of the leading bachelor’s degrees in the finance field.

- B.S. in Financial Planning: A degree in financial planning prepares you to help individuals and small businesses manage their assets and plan for their financial future. Professionals with a financial planning degree usually become personal financial planners who either holistically manage finances, or specialize in an area like investment strategy, estate planning, retirement savings, healthcare planning or income planning.

- B.S. in Financial Management: A degree in financial management prepares you to analyze the financial health of financial institutions and businesses, helping them improve financial performance and increase profitability. Professionals with a financial management degree focus in areas like financial analysis and forecasting, portfolio management, cash management, international finance, and risk management.

- B.S. in Accounting:A degree in accounting focuses on the accountability side of finance, teaching you the ins-and-outs of financial reporting, taxation, auditing, and financial management. This degree prepares you to become a CPA, which can work in any number of settings from corporate to government and private practice.

Knowing which career path is right for you is critical in getting the full value of a finance degree. If you want to focus your career on increasing the financial health of individuals, companies or financial institutions, a degree in financial planning or management can prepare you for success.

When it comes to paying for school, grants are among your best options. But do you know how to find them? Remove the guesswork by downloading this free guide

Five Key Benefits of Getting a Degree in Finance

Finance is a high-stakes industry—individuals and corporations won’t trust their financial future to just anyone. That’s why getting a finance degree is extremely valuable. Here are five real benefits of getting your finance degree:

- Master skills that prepare you for real-world job responsibilities. Unlike more general degrees, like business administration, finance teaches you in-demand skills in areas including data analytics, risk management, capital allocation, and investment strategy. Through coursework you’ll also gain much needed soft skills like collaboration, verbal and written communication, and adaptability.

- Work for a wide range of employers. A minimum of a bachelor’s degree is required for nearly all finance professions. Whether you want to work on Wall Street, for the SEC, or a financial planning consultancy, a finance degree will give you the foundational knowledge you need to start your career.

- Set the stage for getting professional certifications. Most financial professionals get at least one professional certification. For financial planners, the most common is the Certified Financial Planner (CFP), which sets high ethical and skills standards for these professionals. Financial management professionals may choose to pursue a specialty area of expertise, like the Chartered Financial Analyst (CFA) certification or the Financial Risk Manager (FRM) certification. The right finance degree program will focus on topics that prepare you to pass these types of certifications.

- Set yourself up for a financially rewarding career. In 2019, the National Association of Colleges and Employers (NACE) reported that the average starting salary for finance majors was $58,464, while management, director and executive positions easily surpass six figures.

- Join a popular industry that expects stable growth. According to the BLS, employment of all business and financial operations occupations is projected to grow 7% percent by 2028, faster than the average for all occupations, adding about 591,800 new jobs.

What Kind of Jobs Can You Get With a Finance Degree?

As the finance industry grows, technology advances and the regulatory space gets more complex, there are a growing variety of finance jobs. Let’s look at some of the most promising career paths for finance degree holders.

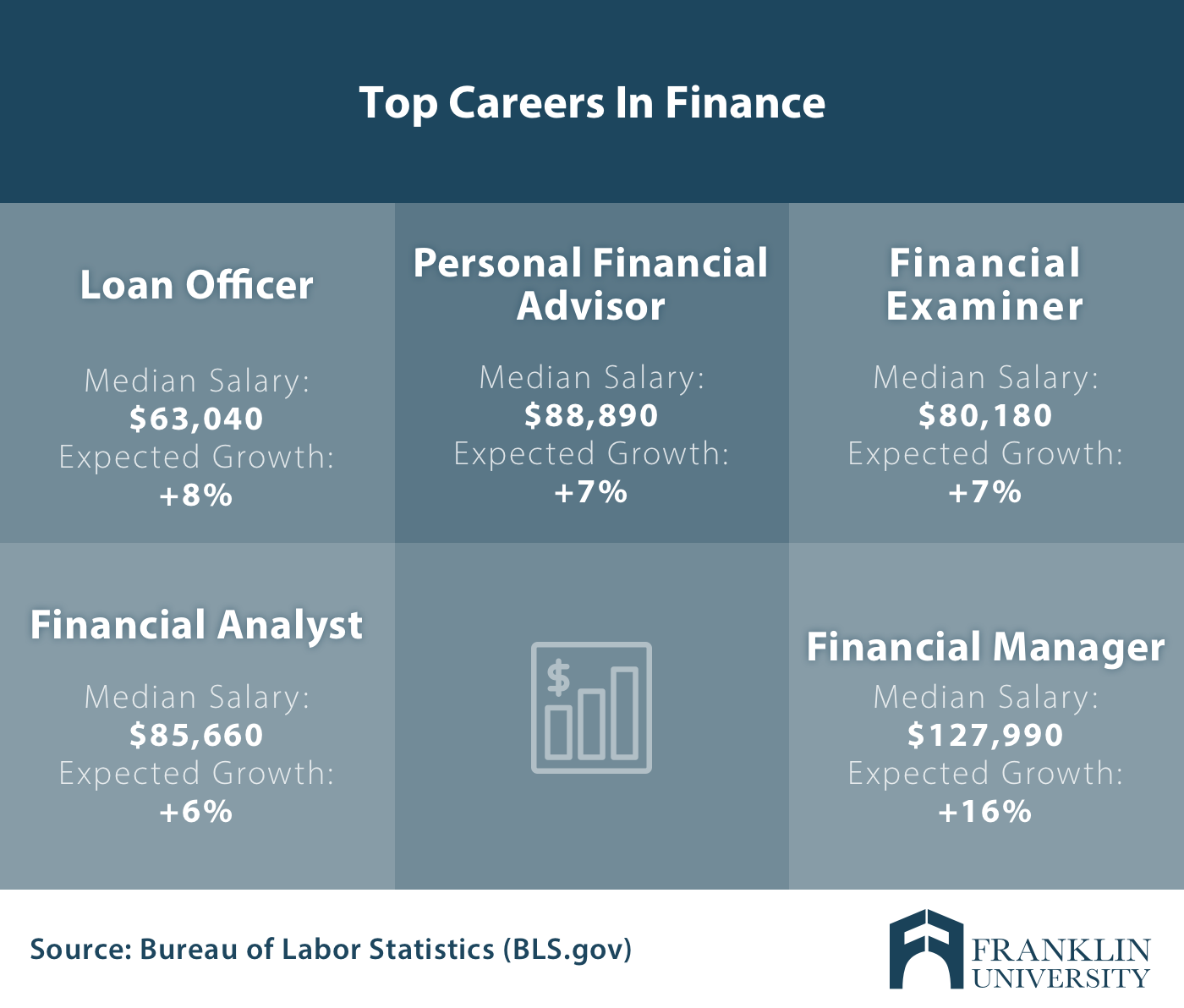

Loan Officer

Loan officers assess, authorize and recommend approval of loan applications for individuals and businesses. They collect and verify all required financial documents and evaluate the information they obtain to determine the applicant’s need for a loan and their ability to pay back the loan.

- Median Salary: $63,040 (BLS)

- Job Outlook (2018-2028): 8%

Personal Financial Advisor

Personal financial advisors help individuals manage their finances and plan for their financial future. They advise and manage everything from investments, insurance and mortgages to college savings, estate plans, and retirement.

- Median Salary: $88,890 (BLS)

- Job Outlook (2018-2028): 7%

Financial Examiner

Financial examiners ensure financial institutions are in compliance with the laws governing them. They review balance sheets, evaluate the risk level of loans, and assess bank management to make sure risk is properly managed and borrowers are being treated fairly.

- Median Salary: $80,180 (BLS)

- Job Outlook (2018-2028): 7%

Financial Analyst

Financial analysts evaluate investment opportunities for businesses and individuals, helping assess the performance of stocks, bonds, and other types of investments. They usually specialize in a specific industry, geographical region, or type of product.

- Median Salary: $85,660 (BLS)

- Job Outlook (2018-2028): 6%

Financial Manager

Financial managers create financial reports, manage investment activities, and develop strategies for the long-term financial goals of their organization. With advances in technology, financial managers now focus most of their time on data analysis to advise management on ways to maximize profits.

- Median Salary: $127,990 (BLS)

- Job Outlook (2018-2028): 16%

What’s It Take to Earn a Finance Degree and Compete for Finance Jobs?

Getting your finance degree isn’t easy—it takes time, dedication and hard work. But getting your degree is only the first step. Here are three things you need to know about differentiating yourself from the competition:

- The best way to learn is by doing. Finance is a meticulous specialty. As you’re learning new concepts, make sure you’re taking advantage of the latest tools and applying what you learn to real scenarios.

- Don’t lose sight of the big picture. It’s easy to get laser-focused on passing courses, but part of the finance profession is understanding the world in which financial institutions operate. Stay curious and stay in tune with the news, politics and global economy that affects businesses every day.

- Take your studies into the real world. Join a professional organization, network with other finance professionals, and find a mentor who can show you what it’s like to work in finance. The more experience you can gain while pursuing your degree, the easier it will be to jump start your career.

Remember, finance is extremely competitive, so you should do everything you can to differentiate yourself. Keeping these things in mind as your complete your degree will help you become a well-rounded professional with job-ready skills.

Find the Right Finance Program For Your Goals

Now that you know what it takes, are you ready to start or advance your career in finance? Then you need to find the right finance program. If you’re a working professional who wants to get your finance degree, you need a flexible, online program that will teach you the latest skills, without pausing your career.

Franklin University provides two different finance degrees for the industry’s most popular career paths—a B.S. in Financial Planning and a B.S. in Financial Management. Explore our programs and see how these degrees can help you accomplish your career goals.